A selection of set-and-forget strategies for on-chain investing

An overview of Calculated Finance (CalcFi) and its value proposition

Introduction

Calculated Finance (CalcFi) is building a selection of set-and-forget strategies for on-chain investing. Their main product is dollar-cost-averaging (DCA) – both standard and more advanced strategies. The protocol is fully non-custodial and leverages on-chain DeFi protocols – a key difference to similar offerings by centralised exchanges.

As of now, CalcFi is only deployed on Kujira (Cosmos SDK chain), but there are plans to launch on other EVM-based chains. So far almost 1,100 strategies have been created and the total amount swapped surpassed $670k.

Team

CalcFi is an Australian company with a team of 4.5 core contributors (0.5 being a part-time contributor and part-time PhD student). They have backgrounds in consulting, tech, enterprise solutions and academia.

In addition to this, there is a CalcFi Strategy DAO with people from different backgrounds (finance, research, science…) contributing to the strategy and growth of the protocol.

What problem is CalcFi trying to solve?

There are two core problems – removing emotions from investing and allowing users to do so in a non-custodial way.

Timing the market is difficult. For most people, a simple set-and-forget strategy leads to the best performance over the long term. By investing regularly over longer periods, DCA strategies allow users to get passive exposure to the market. In addition, they reduce complexity and remove emotions as well as human biases from the equation.

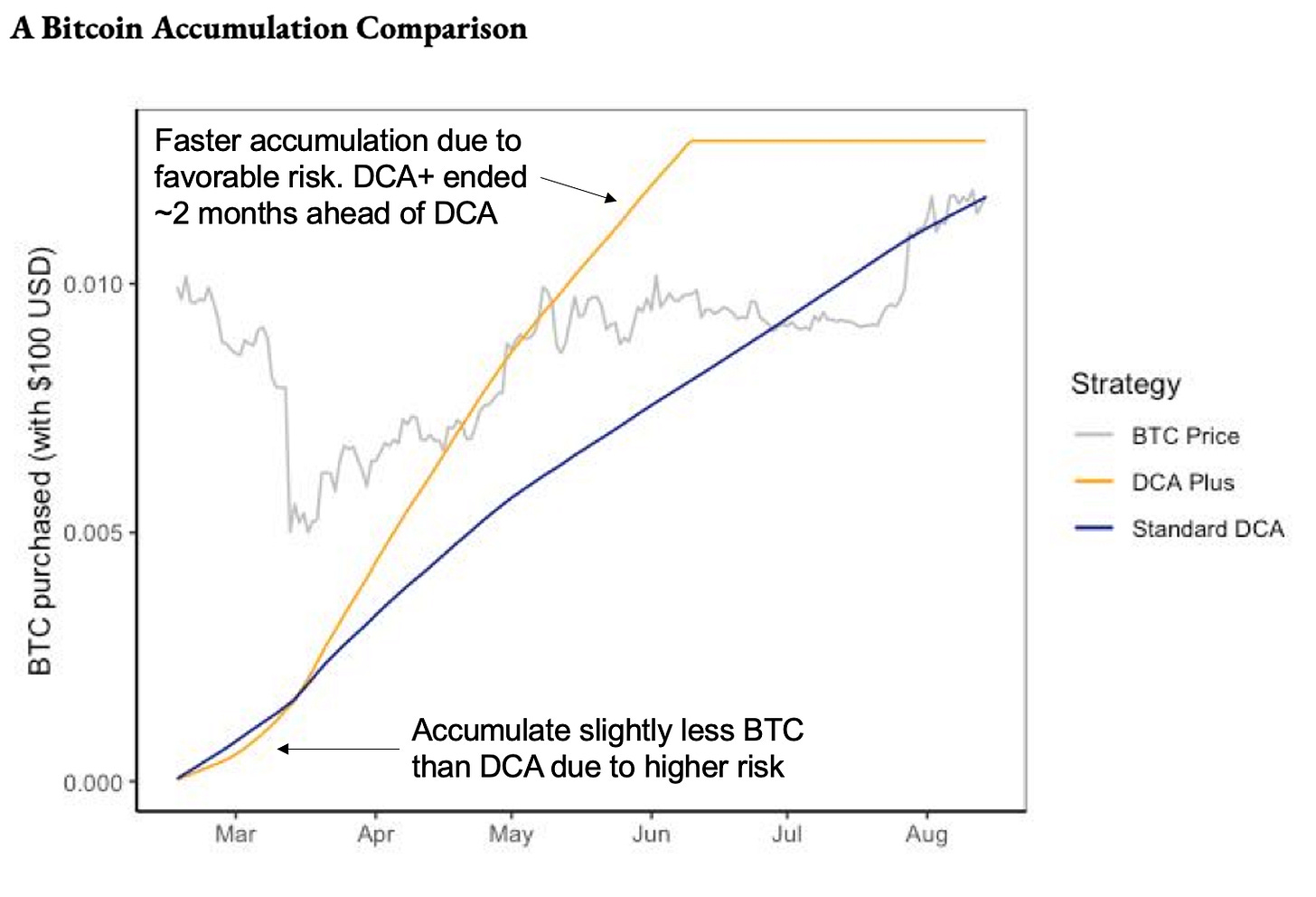

DCA+ takes it one step further by incorporating risk measurements to improve timing and weighting. While DCA solves the “When to invest”, DCA+ aims to also solve for “How much to invest”.

In a volatile asset class such as crypto, getting in early can be lucrative, while starting at the top means withstanding deep drawdowns. Even though starting at the top can be profitable over a long enough time horizon (see chart below), incorporating risk measurement to improve timing can lead to better returns and less stress. This is where DCA+ comes into play.

While many centralised exchanges offer simple DCA products, the risks around centralised crypto-companies should be clear at this stage. On-chain DCA fills a gap in the market for those that want to maintain full custody of their assets.

Who is it for?

CalcFi targets two main groups of users:

Retail investors with limited experience: Someone that wants to invest in crypto, without putting too much time and energy into it. Has some experience from interacting with crypto-wallets and understands the benefits of self-custody.

More experienced investors aiming to remove emotions from investing: The emotional side of investing can be difficult even for experienced investors. Not taking profits or FOMOing at the top are common mistakes. Given that sentiment is usually best at the peak and worst at the bottom, fighting against the crowd can be difficult.

Products

The standard DCA has been live since November 2022 and DCA+ launched in early April 2023. Products under construction are buying the dip and auto take-profit, and future products include portfolio rebalancing and fiat on/off-ramps.

Setting up a DCA strategy includes four steps:

Choose funding and assets: How much to invest, which asset to sell and which to buy.

Customise strategy: Choose purchase frequency (daily, weekly…), duration of strategy and more advanced metrics such as price ceiling/floor and slippage tolerance.

Post purchase: Possible to send assets to a different account and auto-stake with a specific validator.

Confirm and sign: Final check before committing to the strategy.

How does DCA+ work?

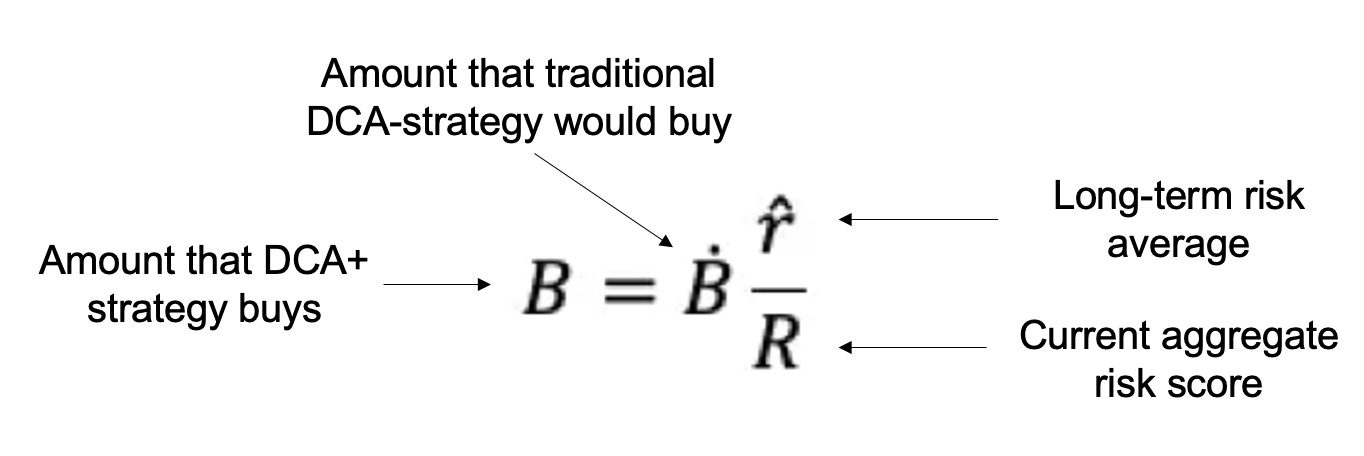

DCA+ utilises machine learning to analyse market trends and adjust investments accordingly. The algorithm assesses risk using several different sources – both real-world measurements (CPI, VIX…), as well as crypto-specific data (trailing BTC volatility).

These risk parameters are aggregated to a risk score, which is compared to the long-term average (determined empirically). Slightly simplifying, the ratio between these two serves as a multiplier on how much to buy compared to a traditional DCA strategy:

When current risk > long-term average → Buy less than traditional DCA

When current risk < long-term average → Buy more than traditional DCA

Is DCA+ better than traditional DCA?

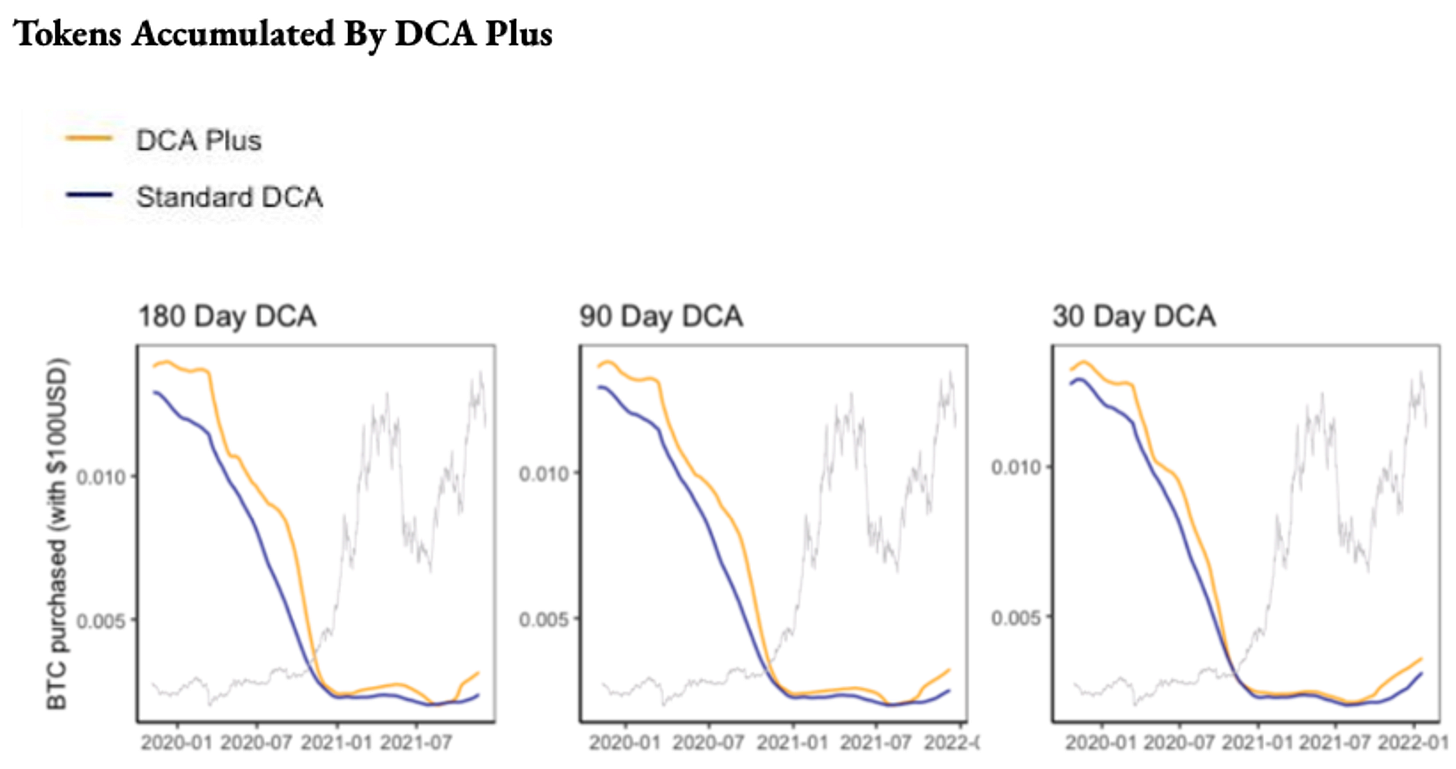

The short answer is yes. When tested on unseen data (data that the model hasn’t been trained on), DCA+ outperformed traditional DCA strategy by an average of 20%. Performance was also better over longer periods (optimal between 3-6 months).

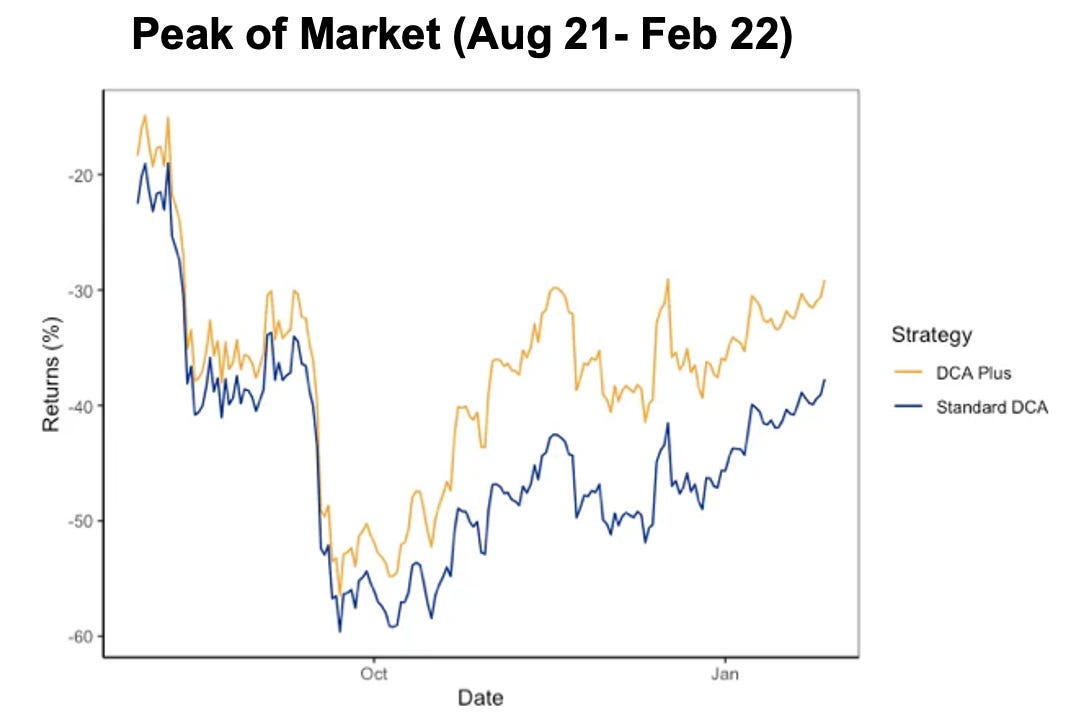

Backtesting indicates that DCA+ not only outperforms in bull markets but also typical risk-off periods (bear markets). While both strategies had negative returns, DCA+ bought less at the top and hence performed subsequently better.

Revenue model

CalcFi makes money by taking a cut from the amount invested. Therefore, flows and volume matters more than TVL.

Traditional DCA strategy: Charges a flat fee of 0.5% on the amount invested. Users also incur a DEX taker fee and slippage, so the final fee is slightly higher.

DCA+: Performance-based fee model. CalcFi charges 20% of the amount that DCA+ outperforms a traditional DCA strategy. No fee if DCA+ underperforms, which makes it a win-win and more aligned with users.

Forthcoming products: Expected to follow a similar performance-based fee model as DCA+ and only charge for the incremental value provided.

Assuming DCA+ outperforms DCA on average by 20%, then the estimated fee is 4% of the notional invested. If using an integrated partner, such as a wallet, that 4% is then further split 50/50 between CalcFi and the integrating partner. In this case, the net fee to CalcFi is 2%.

Since a DCA+ strategy can either end sooner or run slightly longer than a traditional DCA model, measuring performance can only be done once both strategies have finished. Given that performance of the strategy is crucial for determining the fees (20% on outperformance), it will only be applied afterwards.

To get around this issue, 5% of the swapped amount will be stored in an escrow account. Once both strategies have finished and performance can be measured, the protocol takes its fee while the remaining amount is released to the user from the escrow account.

Competitive Landscape

CalcFi’s competition comes from two areas – Centralised exchanges such as Binance and Coinbase, and other on-chain DCA protocols. Competition for on-chain solutions is thinner, and the main competitor is Mean Finance. CalcFi’s key differentiating product is DCA+.

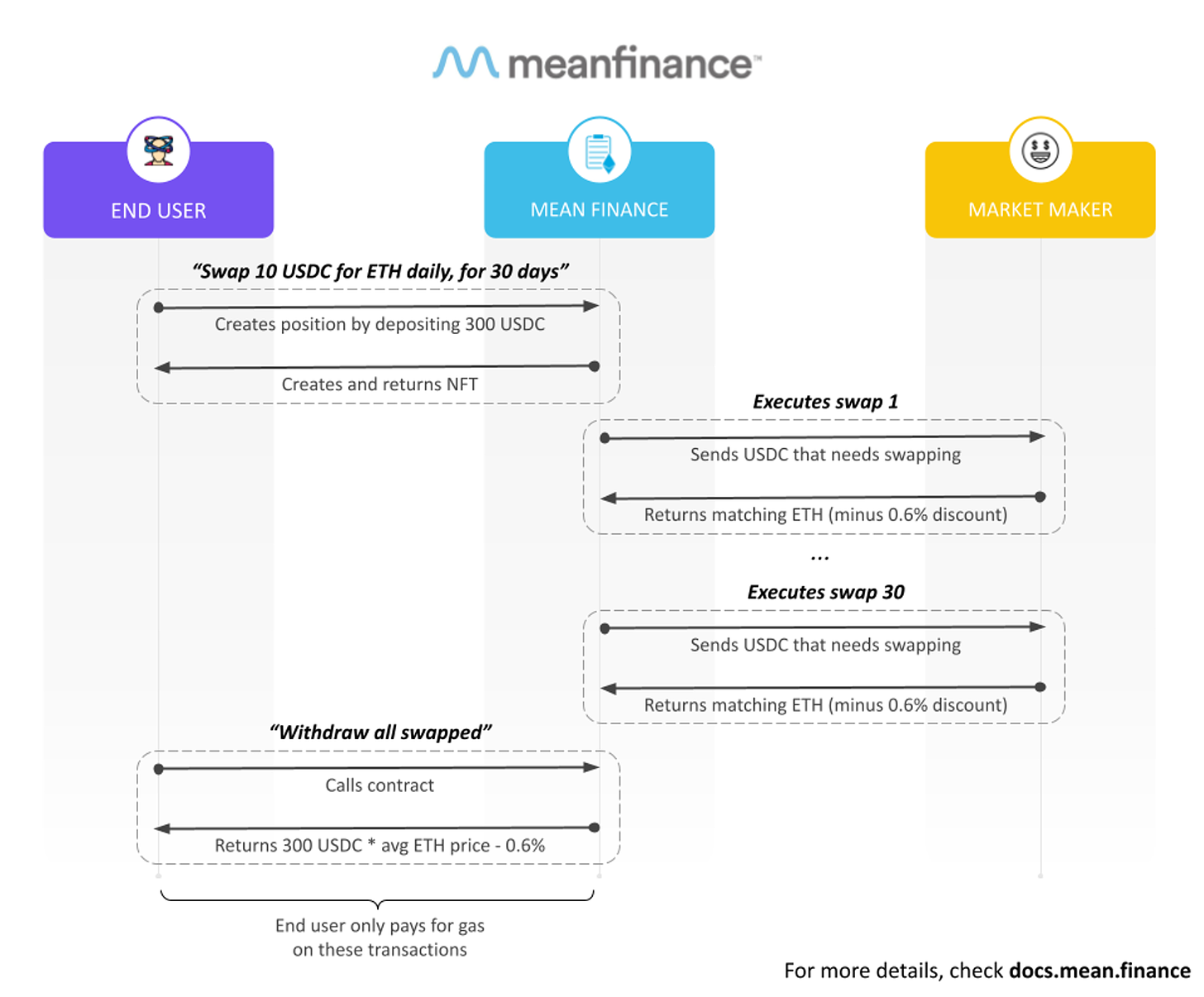

Mean Finance:

Provides traditional on-chain DCA services, where users can choose to buy or sell at a daily or weekly frequency.

Live on Ethereum, Polygon, Arbitrum and Optimism. A range of assets for investors to choose from.

Charges a fee of 0.6% on the total value of assets swapped (Example: if DCA into ETH for $1000, the fee would be 60). Slightly higher than what CalcFi charges on their traditional DCA, but pricing is more transparent for users.

Rather than executing all trades separately, the protocol aggregates trades and lets market makers execute the balance. This way users don’t pay gas fees for each swap. It’s also a lucrative model for market makers, as they share the profits with the protocol (the market maker takes ¾, while the protocol gets the remaining ¼).

Mean Finance has $1.7m locked into the protocol with a total of $5k in fees, so overall adoption for the protocol is still quite low.

Centralised exchanges:

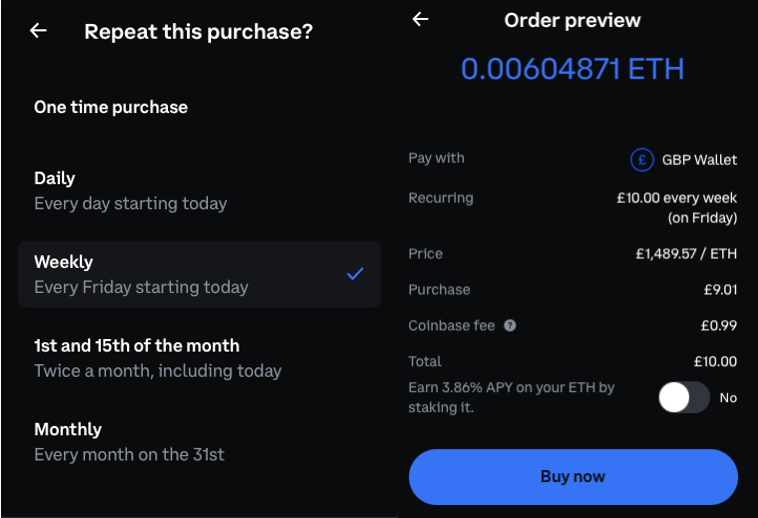

Centralised exchanges offer recurring buys (simple DCA), but there have a few downsides:

Custodial/centralised model: Not your keys, not your crypto. Following the performance of centralised institutions last year, expect a growing number of users that want to use non-custodial solutions going forward.

Expensive: recurring investment programs at CEXs are often expensive. For example, Coinbase charges a fee of £0.99 on a £10 investment (10%!) plus additional fees from FX spreads. While fees reduce in % terms as the invested amount increases, it’s still 3% at the maximum amount of £100 – far higher than for on-chain protocols.

Limited flexibility: more limiting in their offerings and less flexibility for users. For example, Coinbase allows maximal purchases of £100. DeFi also benefits from composability and allows integrating other protocols, such as lending or more personalised staking (choosing which validator to allocate to).

Risks and frictions for adoption

Choice of chain: Kujira is a small chain with only 6.5m in TVL and daily flows of around $220k. This might be friction for growth. While there are plans to expand to other EVM-based chains, it might take longer than expected and introduce technical difficulties.

The effective fee is higher than marketed: Users suffer from both slippage and the DEX-taker fee. Particularly for the traditional DCA, the fee model of Mean Finance and centralised exchanges is more transparent and easier to estimate beforehand than CalcFi.

Multiple ways to measure risk: This is a common topic of debate, as even industry insiders don’t agree on what the right measurement of risk is. While the parameters that CalcFi has chosen seem to work well for the backtested timeframe, economic conditions have changed since then. It raises the question of whether those same risk parameters work in a different market environment.

Future catalysts

Protocol growth following the public launch of DCA+ (April 6th). Additional launches complement the offering and make CalcFi more appealing for those looking for a one-stop shop.

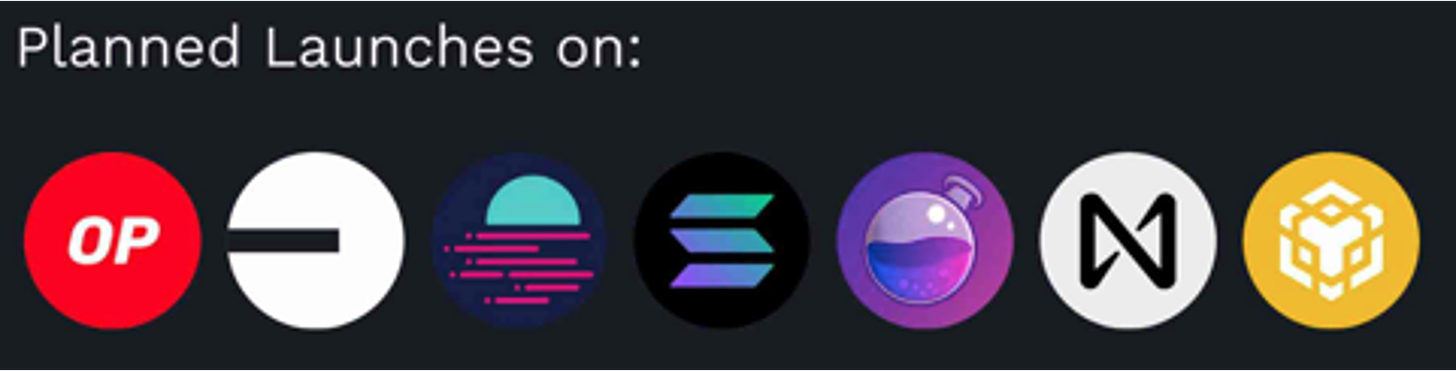

Launching on additional chains than Kujira: Given that Mean Finance is live on all big EVM scaling solutions (Polygon, Arbitrum and Optimism), CalcFi is at a big disadvantage to start with. This is why launching on EVM chains is a priority, and has been confirmed by both the team and internal documentation. While there are no commitments to dates, below are chains that CalcFi is planning to launch:

Token launch: Not yet relevant, but it’s part of the plan down the road. The team wants the protocol to be in a place financially where it can provide sustainable value to token holders (sharing fees), before thinking about launching a token.