Decentralised Finance (DeFi) is the idea of an open and transparent financial system that allows people to transact without intermediaries. It’s powered by public blockchains with logic and rules enforced by smart contracts. DeFi includes applications such as decentralised exchanges (DEX), lending pools and stablecoins.

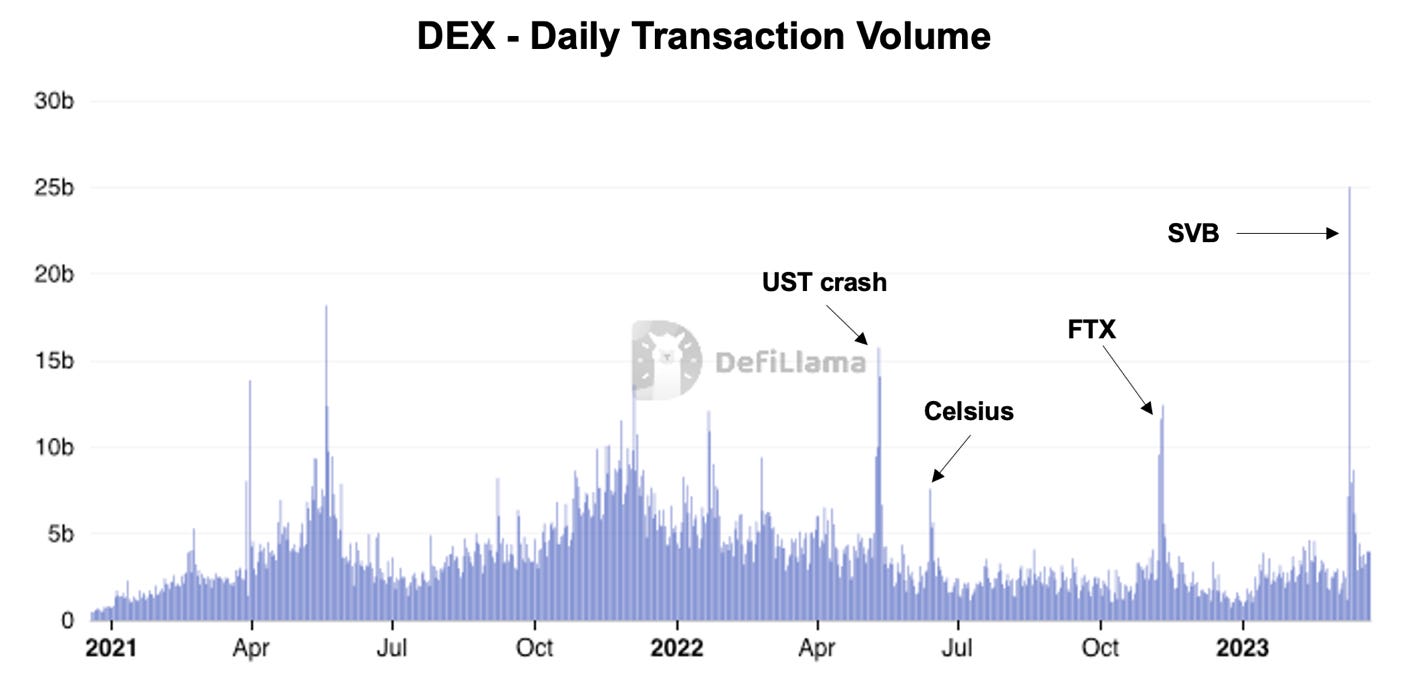

While 2022 was a tumultuous year for crypto overall, DeFi fared well. During times of distress in traditional markets, we saw traders and investors relying on DeFi to get their transactions through. This is visible from the clear spikes in transaction volume.

The collapse of several centralised entities in 2022 has led to a renewed interest in DeFi and its core values – transparency, permissionless and control through self-custody. However, despite those benefits, institutional adoption has been slow.

The slogan “Institutions are coming” gets thrown around a lot, but what does institutional adoption of DeFi even entail? And what are the frictions for adoption?

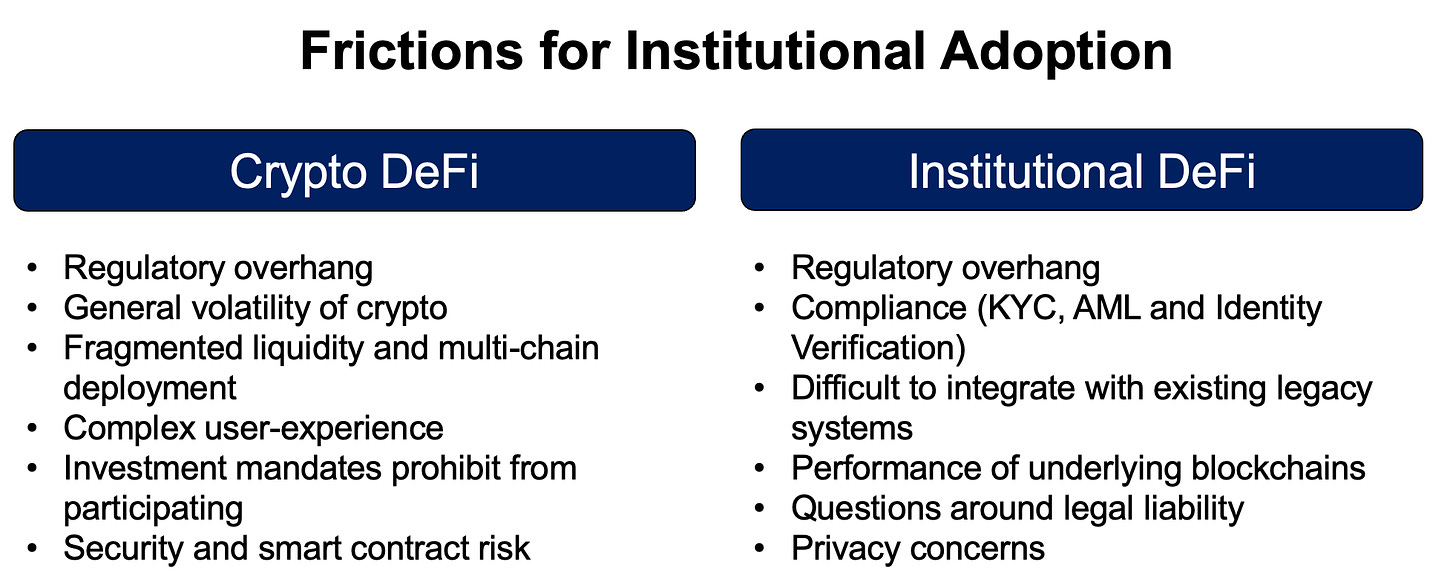

To answer these questions, we first need to separate between two different topics:

1) Crypto DeFi = Institutional investors participating in existing DeFi protocols

2) Institutional DeFi = Financial institutions leveraging public blockchain and DeFi primitives but doing so in a compliant way

Crypto DeFi

Despite current market conditions, more institutional investors are warming up to the idea of digital assets. Many prominent hedge funds are getting involved (for example Brevan Howard and Point72), while BlackRock, the world’s largest asset manager, recently added Bitcoin as an eligible investment to its flagship Global Allocation Fund.

While the share of institutions allocating to digital assets has increased, allocations remain small relative to overall assets under management (AuM). Reasons for investing range from simply chasing higher returns to diversification and gaining access to an alternative asset class.

In a recent survey by Institutional Investor, a sample of 140 US-based investment funds listed yield opportunities as one of their top reasons for investing in digital assets. Participation in DeFi was at the bottom of the list, which is somewhat contradictory given that DeFi is one of the main sources of yield in crypto. However, another survey by BNY Mellon listed DeFi protocol integration as the most important additional feature after custody and execution (N = 271).

So, it seems that investors care about DeFi to generate yield, but it’s not a primary reason to invest. Getting exposure is the first step, after which investors can look for strategies to get additional yield on their holdings – either through staking or DeFi.

Interacting with DeFi protocols can be complex. Luckily, there is a growing range of supporting infrastructure and portfolio management tools for investors to rely on, such as Metamask Institutional and Avantgarde. These make the overall experience simpler and smoother. They also offer controls for team management (who is authorised to trade) and general portfolio management tools (snapshots and reporting).

In addition, structured products such as icETH abstract away the complexity for investors. For the quantitative-minded, platforms like TradingStrategy allow users to create and backtest algorithmic trading strategies for DeFi protocols (even without any prior crypto knowledge).

Institutional DeFi

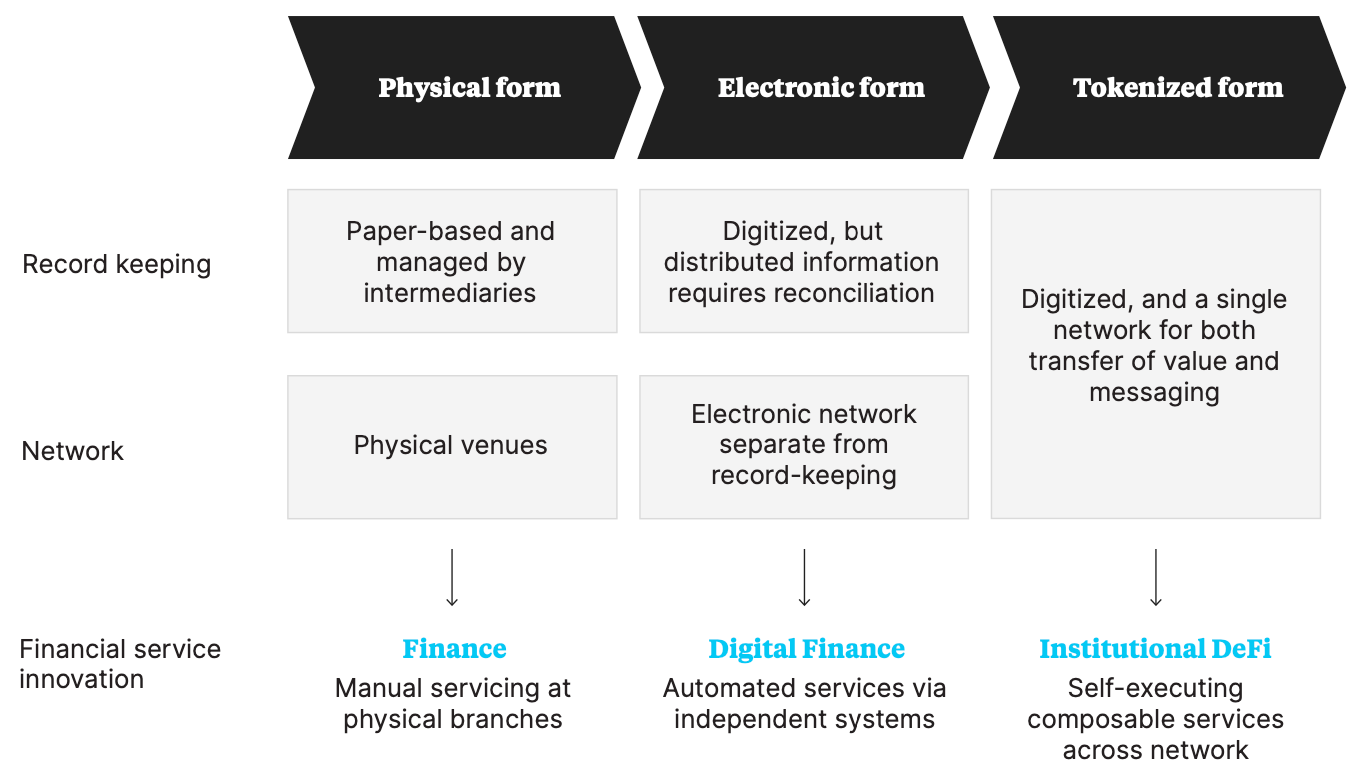

While the last cycle was dominated by private enterprise blockchains, banks and asset managers are now focusing on institutional DeFi – also known as “grown-up DeFi”. It attempts to leverage existing DeFi primitives and public blockchain, while still complying with current risk and regulatory requirements.

By using permissioned pools, only approved or “whitelisted” actors can interact with the protocol. Aave Arc and 1Inch Pro are examples of existing DeFi protocols expanding into the space.

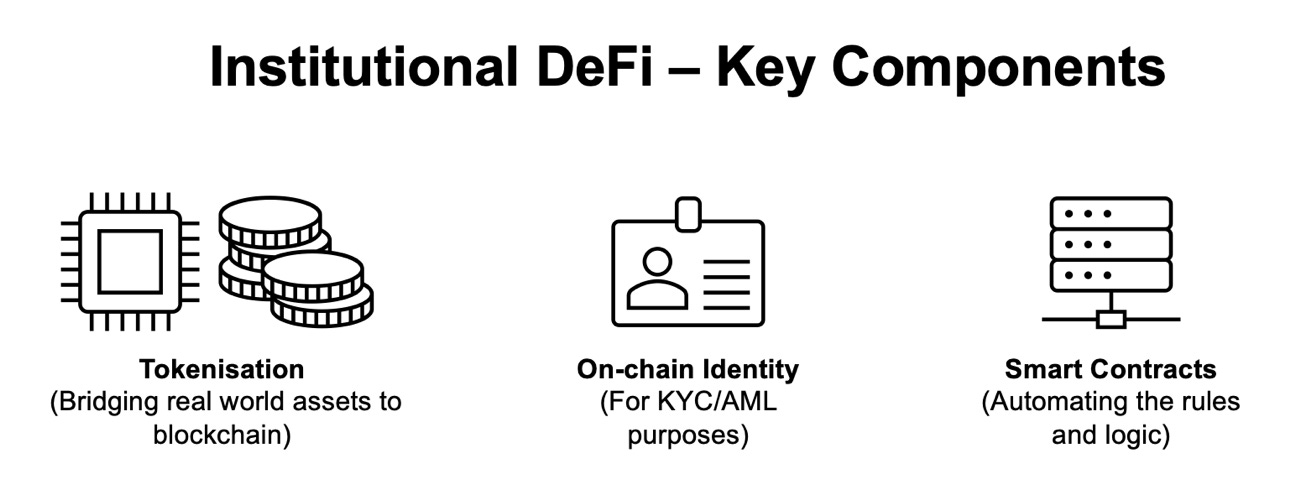

The key components of institutional DeFi are:

Tokenisation allows bridging real-world value on-chain, which enables integration with DeFi applications and smart contracts. Tokenisation is a key area of focus for financial institutions, and bonds and carbon credits are two areas that have already been experimented with.

On-chain identity is important for KYC and AML compliance, as well as making sure only authorised employees within the firm can execute trades. Today verifiable credentials are quite widely used, but the future might see more use of zero-knowledge solutions around identity (as the technology matures).

Smart contracts are used to reduce intermediaries and execute trades automatically. Having the logic and rules embedded into the code reduces the need for human intervention and enables further automation. Win-win, as it saves both money and time for all parties involved.

While trading has become largely digitised, settlement is still a hassle as records are stored in siloed ledgers. Counterparties must message each other to reconcile their books post-trade. Institutional DeFi can improve on the status quo by providing atomic settlement which happens simultaneously with the trade. Other benefits include increased liquidity, reduced intermediaries (typical bond issuance involves 15 actors) and 24/7 markets (Uniswap report of on-chain FX markets).

Some recent examples of pilots on public blockchains include:

Frictions for adoption

Regulatory uncertainty is the overarching concern for investors and institutions alike. While US regulators are clamping down on the industry, the EU is taking a more constructive stance and offering guidance to actors in the space. That said, regulation is expected to be a concern for some time going forward. Institutions can either choose to wait on the sidelines or push ahead nonetheless. Recent examples of companies choosing the latter include Fidelity and Nasdaq.

Some other frictions for adoption include:

ESG has been mentioned as a deal-breaker before and most firms include it as part of their capital allocation framework. However, Ethereum’s move to proof-of-stake (PoS) reduced the network’s energy consumption by >99.9%. Given a large share of DeFi ecosystem exists on Ethereum and its scaling solutions (L2 and sidechains), this concern is now largely removed.

Concluding thoughts

Institutional investors are increasingly interested in allocating to digital assets, but only a small share of their overall portfolio. Similarly, financial institutions are pushing ahead with tokenisation, custody and pilots for institutional DeFi. However, these institutions have many different stakeholders to consider – clients, regulators, shareholders and investors – and the main friction is trying to keep everyone comfortable. Smaller firms can be more agile and aggressive in adoption, but legacy systems won’t change overnight.

A more important question is whether we should even aim for rapid mass adoption in the first place. While slow and consistent growth isn’t as exciting as the hockey stick charts, perhaps it’s better for the industry long-term. As Vitalik recently pointed out, the ecosystem needs time to mature before we get even more attention. While the pace might be slower than some would hope, the direction is still correct.