From Speculation to Utility: Next Steps For Onchain Lending Markets

The vision of onchain lending protocols - a cornerstone of Internet Finance - is to provide equal access to capital for individuals and businesses, regardless of location. Doing so enables fairer and more efficient capital markets, ultimately increasing economic growth.

Despite its potential, onchain lending today primarily caters to crypto-natives and provides little utility outside speculative use cases. This significantly constrains the total addressable market (TAM).

This post explores a step-by-step approach to expanding the user base and transitioning to more productive use cases while navigating potential challenges.

Onchain Lending Today

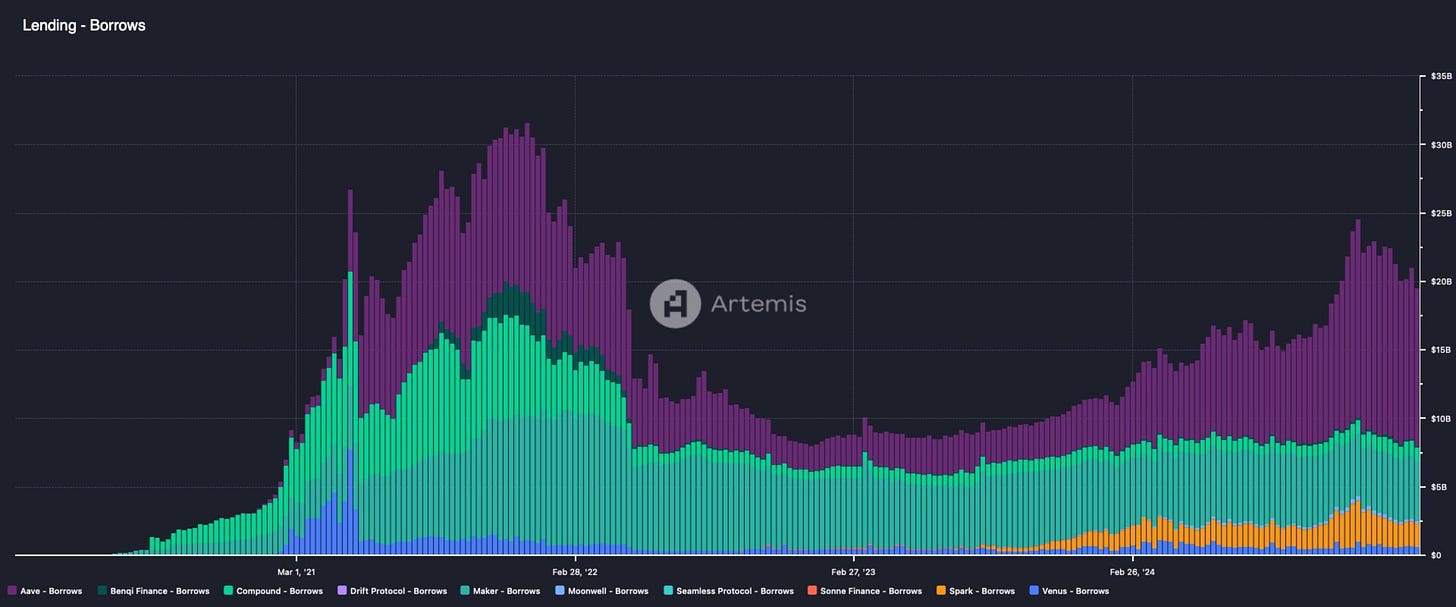

In just a few years, the onchain lending market has grown from an early concept to numerous battle-tested protocols that have withstood several high-volatility events without incurring bad debt. In total, these protocols have amassed $43.7 billion in deposits and $18.6 billion in outstanding loans.

Today, the primary demand for onchain lending protocols comes from:

Speculation: Leverage for crypto native investors to buy more crypto (e.g., borrowing USDC against BTC to buy more BTC, potentially looping that position multiple times to increase leverage)

Accessing Liquidity: Enabling investors to get liquidity on their crypto holdings without selling and potentially incurring cap gains tax (depending on their jurisdiction).

Flash loans for arbitrageurs: A very short-term loan (repaid during the same block as it’s issued) used by arbitrageurs to exploit temporary market inefficiencies and correct mispricings.

All of these target crypto-natives and serve mainly speculative purposes. However, the vision for onchain lending is much larger.

When comparing the total amount of outstanding debt in the world ($320 trillion) or total loans to households and non-financial corporates ($120 trillion), the $18.6 bn that onchain lending protocols have in outstanding loans is merely a drop in the ocean.

The TAM of onchain lending can increase several orders of magnitude as it moves towards more productive uses of capital (e.g., loans to finance small businesses or individuals buying a car or house).

Onchain Lending Tomorrow

Two significant changes are needed to increase the utility of onchain lending:

Broadening the collateral pool: Today, only select crypto assets can be used as collateral, which limits the pool of potential borrowers. In addition, the high collateral ratios (up to 2x or higher to compensate for the high volatility of crypto tokens) further limit borrowing demand. Expanding the pool of accepted collateral enables more investors to borrow against their portfolio of assets and onchain lending protocols to underwrite more loans.

Enabling undercollateralized lending: The vast majority of onchain lending protocols today are overcollateralized (borrowers put up more capital than they borrow), which makes borrowing capital-inefficient and unfeasible for many use cases (e.g., financing small businesses). By embracing undercollateralized loans, onchain lending can appeal to a broader range of borrowers.

Some of these features are easier to implement, while others introduce new challenges. However, implementation can happen in steps, starting with the low-hanging fruit.

Let’s examine each in more detail.

A third feature is fixed-rate lending, but this could be solved by a third party taking over the variable rate risk from the borrower through an interest rate swap or custom-lending agreements between borrowers and lenders, so we won’t cover it here (and some protocols, such as Notional, already offer this).

1. Broadening The Collateral Pool

Compared to other global assets such as public equities ($124 trillion), fixed income ($140 trillion), or real estate ($380 trillion), the market cap of crypto ($3 trillion) is only a fraction of that. Restricting the collateral pool to a subset of crypto tokens significantly limits the growth of onchain lending, particularly as collateral requirements can be up to 2x (or even higher) to compensate for the high volatility of crypto assets.

Combining tokenization with onchain lending enables investors to borrow against their total portfolio of assets more effectively (rather than just a small subset), widening the pool of potential borrowers.

The expansion of collateral is likely to begin with liquid, frequently traded assets (stocks, money-market funds, bonds, etc.), which would require limited changes to existing lending protocols. However, the speed of regulatory approval is a key factor restricting growth here.

In the longer term, expanding to more illiquid and physical assets (such as tokenized real estate ownership) offers an interest growth avenue but also brings unique challenges, such as managing the debt position.

Eventually, we could enable individuals to leverage onchain lending for mortgages where the loan issuance, purchase of the house, and depositing the house as collateral in a lending protocol happens atomically within one block. Similarly, a business could take out a loan to invest in a new plant or machinery by simultaneously depositing that asset as collateral.

2. Enabling Undercollateralized Lending

Today, the vast majority of onchain lending is overcollateralized, meaning borrowers must put up more capital than the amount they borrow. This approach, while ensuring the lender's security, is capital-inefficient and unfeasible for many use cases (e.g., working capital loans for capital-light businesses).

Initial demand for undercollateralized lending within crypto would likely come from market makers and other crypto-native institutions left unserved after the collapse of centralized lending desks (BlockFi, Genesis, Celsius, etc.). Meanwhile, early attempts to do undercollateralized lending in a more decentralized way, such as Goldfinch and Maple, either handle most of the logic off-chain or have pivoted to overcollateralized lending.

One interesting new entrant is Wildcat Finance, which aims to bring back undercollateralized lending while keeping more components onchain. It works merely as a matching engine between individual borrowers and lenders, leaving lenders to assess the underwriting risks.

Outside of the crypto-bubble, undercollateralized lending occurs among both consumers (e.g., personal loans, credit card debt, and BNPL) and commercial entities (e.g., loans for working capital, microfinance, trade finance, and business lines of credit).

The most significant opportunity for onchain lending products is within markets currently underserved by traditional banks. A couple of examples include:

In recent years, alternative lenders have increased their share in undercollateralized lending to consumers, particularly for low- and moderate-income households. Onchain lending can serve as a natural extension of this trend and provide more competitive rates for consumers by

Small businesses are finding it increasingly difficult to get loans (either for expanding operations or covering working capital) as big banks don’t deem it worthwhile due to small transaction amounts.

Challenges To Overcome

While these two changes would expand the potential user base of onchain lending and enable more productive use cases, they also introduce new challenges. Some of these challenges include:

Managing debt positions backed by illiquid assets: While crypto trades 24/7 and many other liquid assets (public equity and debt) trade Monday through Friday, the prices of illiquid assets are updated much less frequently. Irregular price updates make managing the debt position more challenging, particularly in times of high volatility.

Liquidation of physical collateral: While the ownership of a physical asset may be represented on-chain, the liquidation process becomes more involved compared to assets that are fully onchain. With tokenized real estate, for example, the owner might refuse to leave the property without legal proceedings. Given that this falls outside the scope of an onchain lending protocol (and individual lenders), the liquidation right could be sold (at a discount) to a third-party debt collector in the local jurisdiction, who then handles the liquidation.

Determining the risk premium: While defaults are part of the lending business, the default risk should be incorporated in the risk premium (additional rate on top of the risk-free rate). Estimating default risk is primarily relevant for undercollateralized lending. While the required metrics to estimate this differ depending on the borrower, we already have tools to do this today:

Consumers: Web proofs, ZKPs, and decentralized identity protocols can help consumers prove their credit score, current income, employment status, and other personal data in a privacy-preserving way.

Companies: By integrating common accounting software and attested audit reports, companies can prove their cash flows, balance sheets, and more. In the future, if (or when) all finance eventually flows onchain, company data can be directly integrated into the lending protocol or 3rd party credit rating service in a more trust-minimized manner.

Decentralized credit risk model: Banks leverage internal customer data on top of externally available data to train their credit risk models, which help them determine underwriting risk. The data silos not only increases the barrier of entry as new entrants don’t have access to the same amount of data, but is also challenging to do in a decentralized manner (one entity doesn’t control the model, and data needs to be kept private). However, decentralized training and inference are improving quickly. In the future, decentralized protocols could leverage these methods to train a credit risk model and do inference in a privacy-preserving way.

Other challenges include onchain privacy, adapting risk parameters as the collateral pool expands, regulatory compliance, and making it easier to use borrowed proceeds for real-world utility.

Conclusion

While they’ve set a strong foundation over the last few years, onchain lending protocols have merely scratched the surface of their full potential.

The next phase of onchain lending is significantly more exciting. We expect protocols to expand slowly from crypto-native and speculative use cases to more productive ones.

In its final form, onchain lending helps level the playing field by providing companies and individuals equal access to capital, regardless of location. As Theia Research recently summarized, the goal is “a financial system where NIMs compress towards the cost of capital.”

That’s a north star worth fighting for!