Scaling Consensus with DVT

Exploring the value of Distributed Validator Technology (DVT) ahead of the Shanghai upgrade

The 5 key takeaways are:

The Shanghai/Capella upgrade will allow withdrawing staked ETH. It’s the final step in Ethereum’s PoS transition and is planned for mid-April. It serves as another major derisking event and is expected to increase Ethereum’s staking rate (currently 15%). However, not all staking is the same and quality matters.

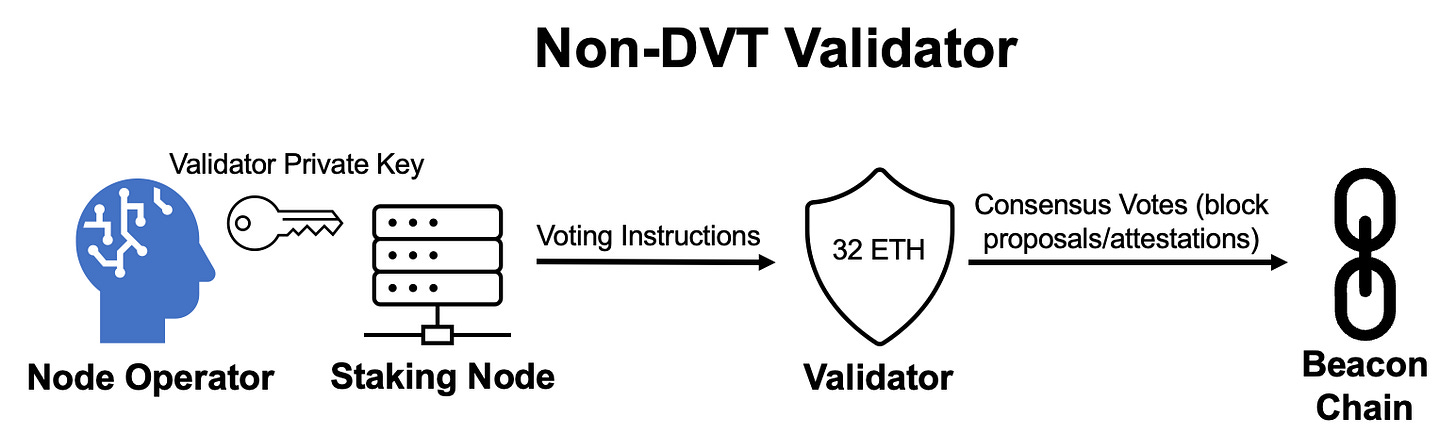

Single point of failure: Currently, validators are being run by a single node. This makes the validator vulnerable to social and technical risks. Both software and hardware fail regularly, and this single point of failure can threaten the strength of the underlying network.

Distributed Validator Technology (DVT) is a technical solution that allows proof of stake validators to run on multiple nodes/machines. It can reduce risks and increase returns for stakers, as well as improve the overall resilience of Ethereum. However, DVT doesn’t come without costs, and risks include additional complexity and potential latency.

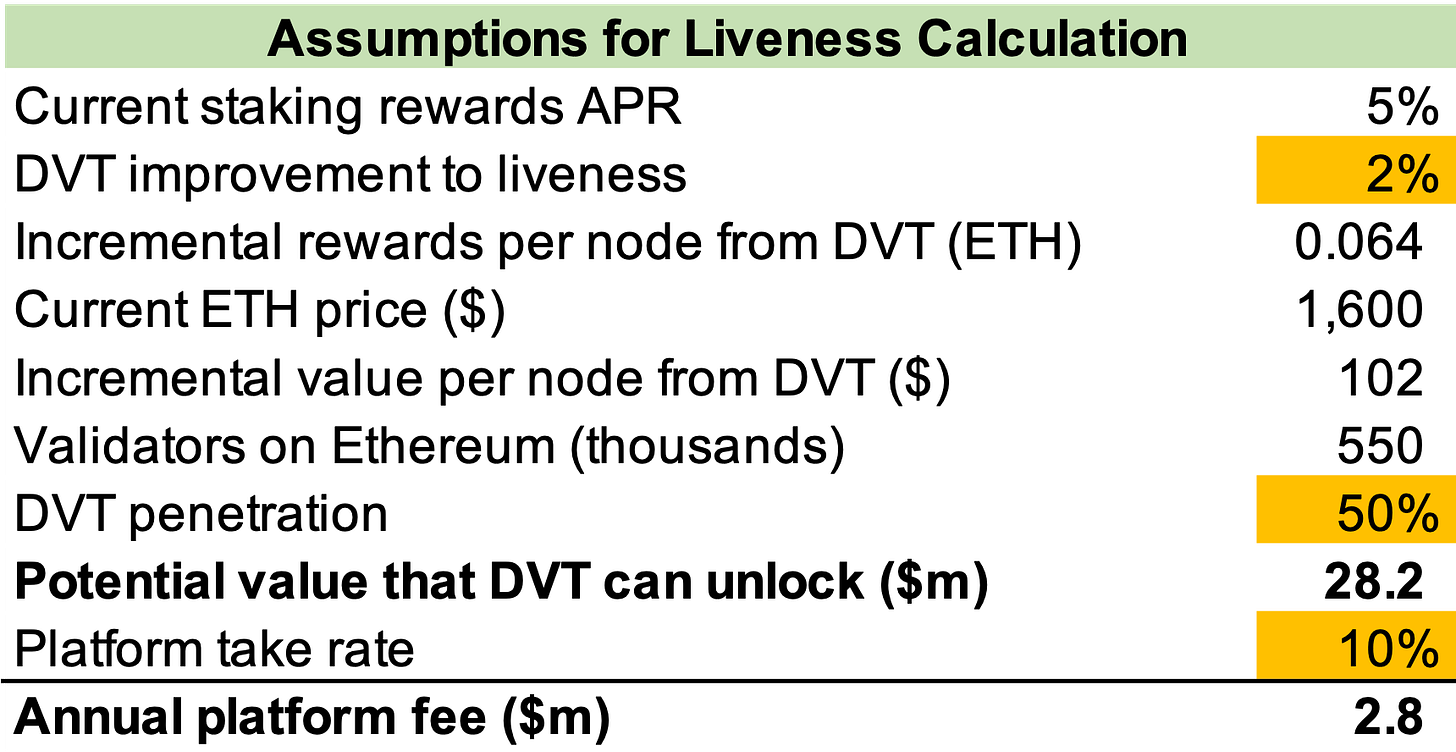

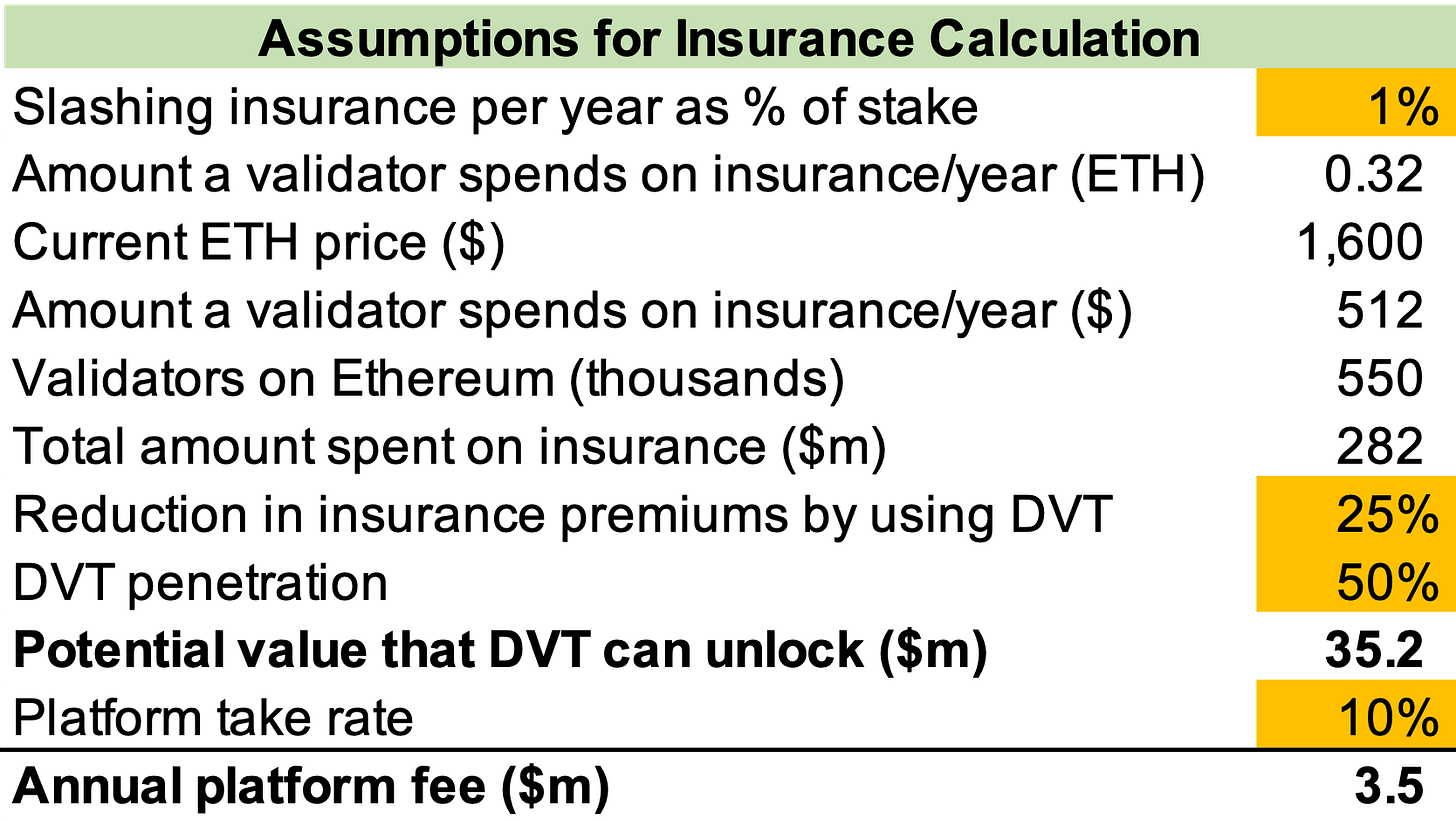

Two frameworks to think about the value of DVT are incremental earnings from higher liveness and reduced slashing insurance. While the most immediate benefit from DVT comes from a reduction in slashing insurance, in total DVT can bring annual savings of more than $200/validator at current prices (~10%).

The two main players in the space are SSV Network and Obol Labs: Both have the same end goal, i.e. running distributed validator nodes, but their approaches differ slightly. Obol launched the first distributed validator on mainnet in February, while SSV is expected to launch theirs by the end of Q2.

Introduction

As Ethereum moved to PoS, the network became secured by the economic value locked into the protocol rather than computational power as in PoW. While the Merge went smoothly, another key event is yet to come. The long-awaited Shanghai/Capella upgrade is expected for mid-April and will allow users to withdraw their staked ETH. This enables stakers to realise accrued rewards and serves as another major derisking event. Allowing withdrawals removes the illiquidity premium with staking, or at least significantly reduces it.

The upgrade is expected to induce more people to stake, which would increase the staking rate on Ethereum (currently 15%) and get it more in line with other PoS networks. While more people staking is generally good (higher security budget for Ethereum), it also raises some questions about different forms of staking and whether all staking is worth the same. And what does it mean to “scale the consensus layer”?

This post will cover:

Ethereum staking 101

DVT - scaling the consensus layer

Benefits of DVT

Scale vs Diversity

Competitive landscape - SSV and Obol

Risks and tradeoffs

How much are validators willing to pay for DVT?

Where do we go from here?

Concluding thoughts

Ethereum staking 101

To become a validator on Ethereum and help secure the network, one needs to put up 32 ETH at stake (~$50k at current prices). Alongside the high cost of setting up a node, not everyone has the interest or technical know-how required to actually run the node software on their computers. These frictions have created a market for professional staking providers in the form of liquid staking derivatives (LSD) protocols, staking pools and centralised solutions. Today professional staking makes up ~70% of the total staking market, with LSDs alone accounting for 45%.

The two primary roles of a validator are:

Checking new blocks and confirming they are valid (“attestation”)

Proposing new blocks when selected randomly from the pool of validators

Validators earn rewards for making votes consistent with the majority of other validators, proposing blocks, and participating in sync committees. Most of the time validators are just doing attestation, as the other two roles are selected at random. Block proposer rewards can be more lucrative but happen infrequently, which is why attestation rewards are the most common type of reward for stakers.

In order for the node to vote on blocks and earn rewards, it has to be online. This measure is called liveness or uptime and is commonly used for comparing node performance. In order to improve liveness, validators commonly run two machines (one main and one backup). This doesn’t come without risk, however, as the two machines could be online at the same time causing double-signing (slashable event). Trying to blindly maximise liveness can lead to catastrophic outcomes such as mass slashing. An example from the past is Staked, which had 75 of its validators slashed due to a technical issue back in 2021. Therefore, liveness has to be balanced with safety (one benefit of DVT!).

Just rewarding good behaviour is not sufficient, we also require punishment for nodes that misbehave (carrot and stick). Negative incentives come in the form of slashing and penalties. These are sometimes confused, but the main difference is that slashing is against provable malicious actions, whereas penalties are for lighter breaches such as machine failure or being offline.

Slashing acts as a self-defence mechanism in PoS networks - the immune system that fights against attacks. There are three reasons a validator can be slashed:

Double signing = proposing and signing two different blocks for the same slot

Double voting = attesting to two candidates for the same block

Reversing on a previous decision = Validator changing their stance on something they said was true in the past, in an attempt to modify the historical state of the chain (trying to change history)

With both slashing and downtime, the punishment is more severe during correlated events. The anti-correlation penalties are aimed to make the system more robust and disincentivise a large-scale attack. Taking slashing as an example: An uncorrelated event leads to a slashing cost of max 1 ETH, whereas a larger correlated slashing can cost the entire stake (32 ETH) and all earned rewards.

DVT - Scaling the Consensus Layer

Currently, validators are being run by a single node. If the node/machine goes down, the validator goes down. Servers die regularly and software doesn’t run forever without issues. In addition, malicious actors that get hold of the validator key have the power to ransom, slash or shut down the validator. This introduces a single point of failure to staking.

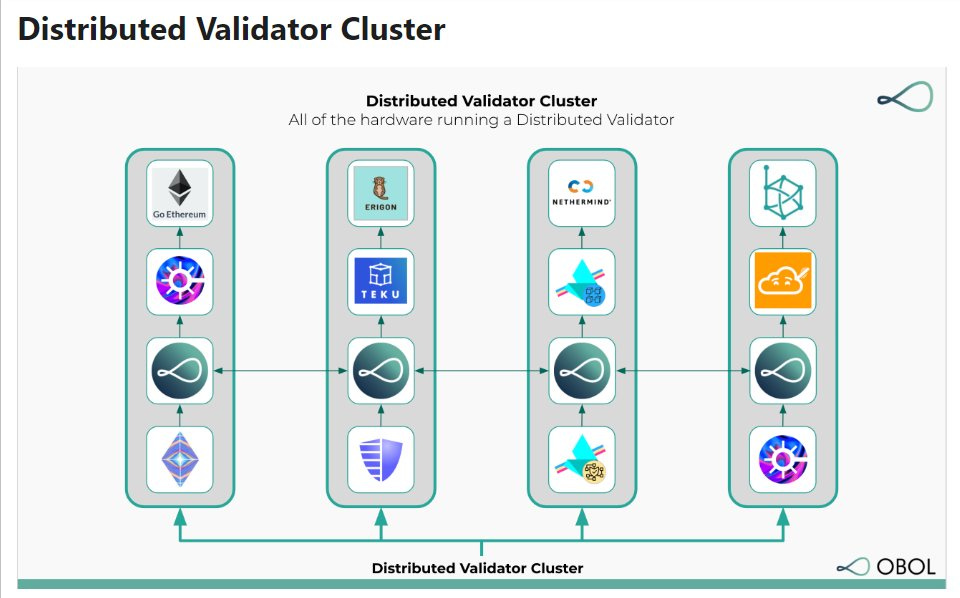

Distributed Validator Technology (DVT) is a technical solution that allows proof of stake validators to run on multiple nodes/machines. By running validators as communities rather than individually, DVT aims to make staking more robust and decentralised, reduce risk and avoid reliance on any single point of failure.

The three main components of DVT are:

Distributed Key Generation splits the private validator key into as many parts as there are node operators. No single operator can recreate the validator key and perform signatures on its own. Instead, the validator's responsibilities are split among a group that works together and agrees on how to vote before signing.

M-of-N threshold signature allows reconstructing the private key without requiring every key share. Even with some nodes offline or compromised, the private key can still be reconstructed if the threshold is met (for example 2/3). In this sense, DVT is to validators what multisig is to wallets. Typically uses Shamir’s Secret Sharing algorithm.

DVT consensus mechanism is used to determine how nodes agree on what to sign and vote for. Consensus must be reached quickly or else the validator is left without rewards (Ethereum’s blocktime is 12 seconds). DVT protocols use either the Istanbul BFT Consensus (IBFT) algorithm or a version of it (such as QBFT). IBFT requires a minimum of four participants to be fault tolerant.

Benefits of using DVT

While DVT stands to benefit all Ethereum users through a more robust infrastructure, the direct beneficiaries are various stakers and node operators. Larger stakers benefit from more optimised infrastructure costs and higher availability, while smaller validators (solo stakers and home validators) can achieve comparable protection to larger validators and diversify their staking across multiple nodes.

The three key benefits of DVT are:

Reducing single-point of failure: With DVT, the validator is no longer tied to the performance of a single node. Running a validator across multiple nodes improves the overall robustness of the network. In addition, threshold signatures combined with distributed key generation mean that no single person/entity holds the full private key for the validator. This makes key theft more difficult, as multiple nodes would have to be compromised for an attacker to get control of a validator node.

Decentralisation: Allowing validators of all types to use DVT can lower the threshold for participating in consensus. This increases decentralisation across the network, particularly with more independent node operators and home stakers getting involved. However, blindly staring at the number of nodes can lead to a false sense of comfort. For a more holistic picture, one needs to consider a range of measures, such as node infrastructure and geographical location (more below).

Higher staking APR from increased liveness and lower slashing risk: As long as the threshold is met, DVT allows the validator to perform its duties even if some nodes are offline. In a similar fashion, since one compromised node can't submit erroneous information on its own, the likelihood of slashing is reduced. Both of these allow stakers to get a better return and optimise their earnings (more detailed calculations under the section on validators’ willingness to pay).

Scale vs Diversity

Both the phrase “scaling the base layer” and “diversifying the base layer” are commonly used in the context of DVT. While both phrases have the same end goal in mind, the difference in wording is worth expanding on a bit:

Scaling focuses on increasing the number of nodes that participate in consensus (machines). Having more nodes is not necessarily better if they all rely on the same infrastructure or are clustered within one jurisdiction/geographical location. Therefore, scale in itself is not sufficient.

Diversity is a more holistic measure that includes having a diversified selection of different client, server and staking providers. This improves decentralisation and makes Ethereum more antifragile.

In other words, it’s not only a matter of increasing nodes but also how you do it (quality AND quantity). The reason these concepts become blurry is that 1) there is no clear definition and 2) diversity is often a second-order effect of scale. With more nodes involved in consensus, the validator set more closely represents the underlying network.

Lowering the threshold to run a validator node while improving safety, liveness and non-correlation risks make new entrants feel more comfortable entering the space. For example, DVT can be used to reduce capital requirements for homestakers by splitting the 32 ETH amongst several operators. All are jointly responsible for running the validator and incentivised through their economic stake in it.

Diversity is also an important part of reducing the correlation risk. Correlated events not only lead to higher penalties/slashing but also make the network more vulnerable to attacks. An example of how diversity could manifest itself is having a broad set of clients (consensus and execution). This means that a software update or failure in one client doesn’t risk the health of the overall network. Other examples that affect diversity are geographical location, legal jurisdiction and technical setups.

In a free market, operators offering more diversification should trade at a premium, as this improves the robustness of the validator (less risk, more earnings).

Competitive Landscape

The two main players in the space are Obol Labs and SSV Networks. Both originally stem from an early proof-of-concept within the Ethereum Foundation, but later departed as separate projects as the vision evolved. Today SSV seems more focused on providing B2B solutions for liquid staking protocols and professional node operators, while Obol is more open to any validator. For example, Obol allows home validators to directly pool assets with others to reach the 32 ETH limit.

However, both have the same overall aspiration i.e. running validator nodes in a more distributed way. There are also some common denominators across the two protocols, such as the minimum number of nodes (or shares that the key is split into) - which is 4.

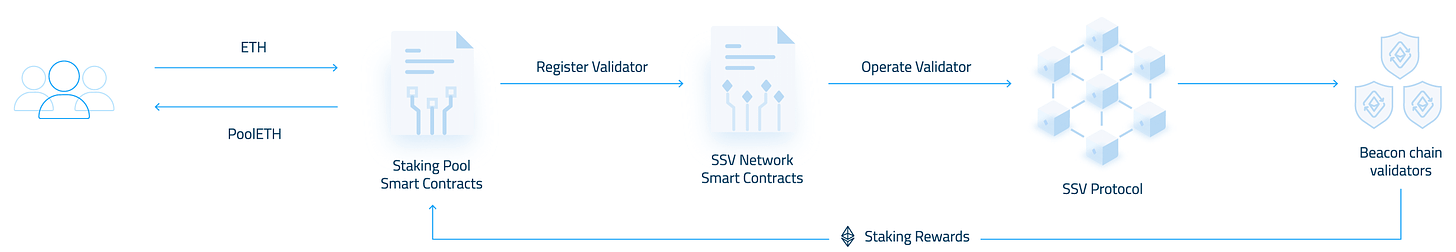

SSV Network

Vision: Be a permissionless and distributed infrastructure layer for Ethereum on which developers choose to build their staking applications and protocols.

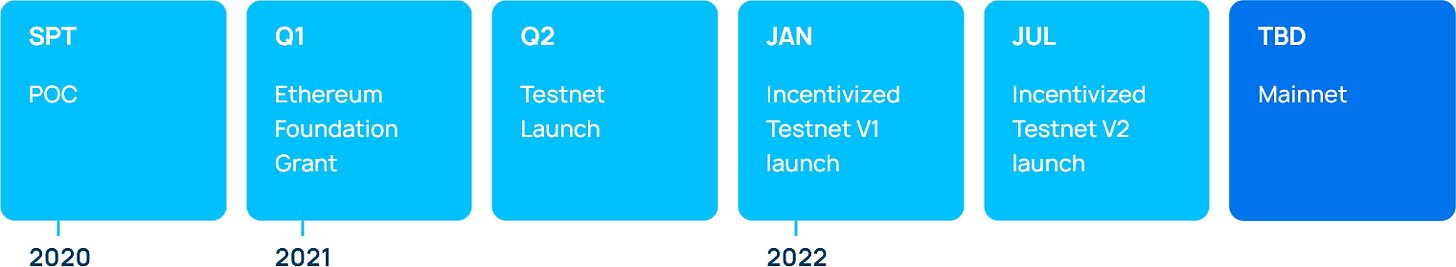

Roadmap: SSV is currently in incentivised testnet, with a mainnet launch expected by the end of Q2 2023. While the ramp-up will be gradual, SSV has ambitious plans by targeting 2/3 of staked ETH to be run by DVT and solo stakers within 3 years.

Source: SSV Network Key Components:

P2P Network Layer is the execution layer that operates the validators on the network and reads validator assignments from the Ethereum smart contract (such as whose turn it is to prose a block).

Ethereum Contract Layer is used for network governance, as well as ranking and assessing SSV operators. Other actions that occur on this layer include adding an operator, creating validators and distributing fees.

Economics: Operator and network fees are denominated and paid in the native token $SSV, which means validators/stakers are required to keep a constant balance of $SSV to fund expenses. Operators set their own rates as they wish and the fee can fluctuate. This leads to a free market of node operators, as those operators with higher performance and better prospects can charge a premium. However, the native-token model is more complicated for stakers and requires them to hold a balance of $SSV, which can act as friction for adoption.

$50m Ecosystem Fund: Dedicated solely to expanding and developing use cases for DVT technology. The SSV DAO partnered with VCs in the space to raise the funds. So far, SSV has allocated almost $2m across 30+ projects through this fund and previous grant programs. The full list can be found here.

Funding: SSV raised $10m in Feb 2022 from investors including Coinbase, DCG, Lukka and Gate.io. They have a treasury worth $20m, of which >70% is in $SSV.

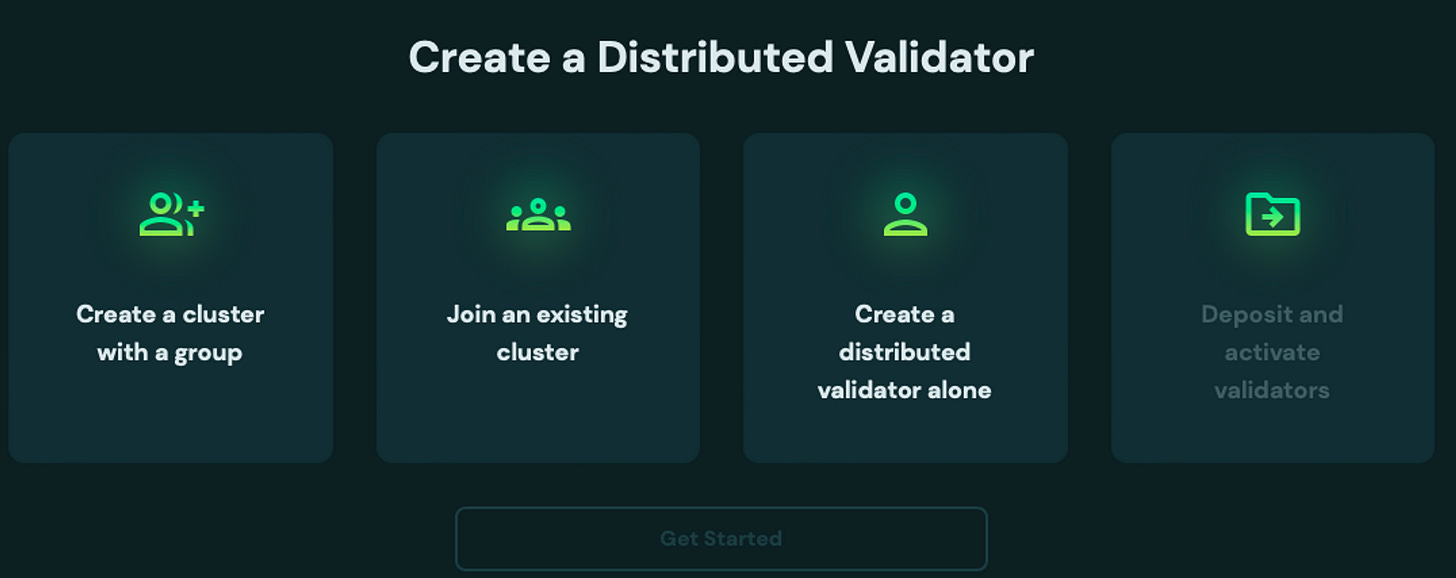

Obol Labs

Vision: Build a multi-client DVT protocol that allows any validator to join clusters without trusting (or even knowing) who the other operators are in the same cluster

Roadmap: Obol’s distributed validator (and the first ever!) has been live on the Ethereum mainnet since the end of February and recently proposed its first block. Node operators are located in Ireland, Estonia and Canada and all nodes are run from a home environment - the purest form of validation. This was the first step in launching Obol V1 on mainnet, with further steps allowing more validators to use the platform. V2 focuses on trust minimisation amongst distributed validators and work is already underway. Expect more details about V2 in Q2 2023.

Key Components:

DV launchpad is the user interface that’s used for creating a distributed validator. Done by either creating a new group, joining an already existing one or creating a distributed validator alone.

Charon is the middleware that sits between the validator client and the beacon node. It allows distributed nodes to run in a permissionless way and is responsible for reaching consensus and combining signatures from the different nodes across the validator cluster.

Economics: All payments are made in ETH and there is no native token as of now. The platform fee is used for funding the DVT ecosystem and projects building in the space (for the entirety of V1).

Team: Founded by Collin Myers (CEO) and Oisin Kyne (CTO), who both worked at Consensys before founding Obol. Kyne also had a stint at BlockDaemon, which provides infrastructure for professional staking. The core team currently consists of more than 20 people and is spread across the world.

Funding: Obol has raised a total of $19m in two rounds, with the most recent one being a series A this February where they raised $12.5m. Backers include Pantera Capital, Archetype and Coinbase Ventures.

Risks and Tradeoffs

While DVT increases decentralisation and the overall robustness of the system, it doesn’t come without costs. The benefits of DVT are valuable, but it’s important to weigh them against the tradeoffs:

Increased complexity: Running a validator in a distributed way requires coordination. The additional consensus layer between node operators increases complexity and introduces more moving parts to the validator setup. This adds potential areas where things can go wrong, similar to any multi-node deployment.

Latency: The added consensus mechanism and message-sharing across nodes lead to additional “hops” that the network has to do. This requires more computation compared to each validator being run by a single node and risks adding latency to the network. While there is some risk of higher operational costs for stakers, professional stakers can offset this by running their validators on fewer machines due to improved resilience. Homestakers are more vulnerable, as they might only run one or two nodes. This makes them more price-sensitive as they can’t offset the increase in the same way professional stakers are able to.

Free-rider problem: A free-rider in the context of DVT is a node operator that enjoys rewards, but doesn’t actually do any work (or does less work than other node operators). This is possible in theory thanks to threshold signature, which means that the validator can still perform its duties even if some operators are offline. Freeriding can be prevented on a protocol level by only paying rewards to operators that were online during a particular block (as will be the case with Obol V2). Another way is by scoring node operators based on characteristics such as liveness and letting market forces determine the value of the operator. In this case, operators with higher liveness would be able to charge a higher fee while the free-rider would be forced to either improve their operation (work harder) or be satisfied with a lower fee. This is the model SSV is taking.

Lower threshold for corruption: Since DVT relies on threshold signature, the share of nodes required to corrupt the network is actually slightly lower with DVT than without (exactly 2/3 without DVT). However, given the number of nodes increases with DVT, an attacker would have to gain control of a larger number of nodes for the network to be compromised.

How much would validators pay for DVT?

Even if the idea originally came from a collaboration with members of the Ethereum Foundation, there is no free lunch here. The protocols building DVT-tech and their investors expect to get paid. In addition, professional node operators need to get compensated for running the nodes. They have both operational costs to cover (hardware, electricity…) and the opportunity cost from committing computing power towards running distributed validator nodes.

The financial model of the DVT platforms is roughly the following: The node operators get most of the fees, while the DAO takes a small cut in exchange for providing the infrastructure (network fee/platform take rate). The network fee would most likely settle around 5-10% - in line with the typical fee at other marketplaces.

Validators’ willingness to pay depends on what they can get in return. Using DVT can lead to higher uptime and lower slashing risk, both of which improve staking APR. This offers us two perspectives to think about potential fee income to DVT protocols:

Incremental rewards from higher liveness: Higher liveness means nodes are online for a larger amount of time, which ultimately leads to more rewards for the validator. From this standpoint, the maximum a validator would be willing to pay is when fees to the DVT provider = incremental earnings from higher liveness.

The penalty for being offline is losing an amount similar to what the validator would have earned. This implies that the improvement in earnings is ~2x the improvement in liveness. With current staking rewards around 5%, a 2% increase in liveness from using a DVT setup would imply incremental earnings to validators of 0.064 ETH or ~$100 per year at current prices (assumptions below).

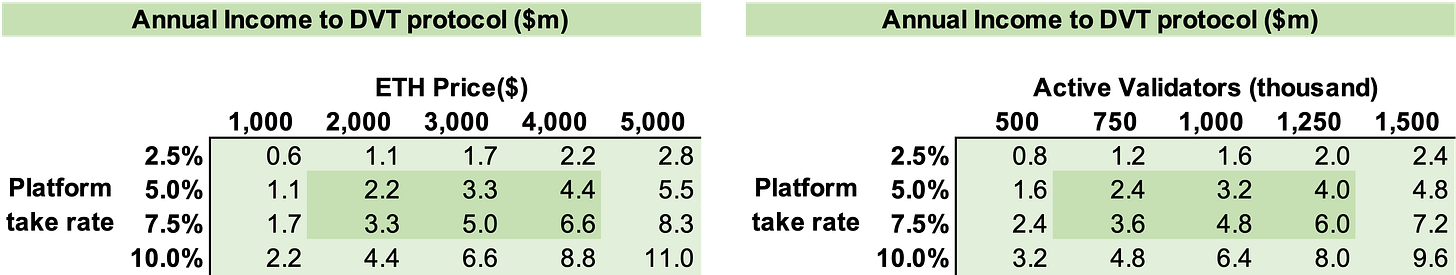

With almost 550k validator nodes currently, this would imply an annual opportunity worth ~$28m if we assume DVT penetration to be 50%. While the assumption that 50% of validators adopt DVT is ambitious, any growth in staking (more validators) would serve as a countering force to a lower DVT penetration. These variables can of course be adjusted to test for different scenarios. Below is an example flexing the platform take rate, ETH price and number of validators:

Slashing Insurance: The worst possible thing that can happen to a validator is losing their entire stake (32 ETH) due to slashing or key theft. Insurance is by definition NPV < 0 (insurance companies need to make money on average), but we still end up paying for insurance because it’s nice to get compensated if your house burns down. While only 229 nodes have been slashed so far (0.04%), the catastrophe scenario might still be worth insuring against.

Slashing insurance is sold by the likes of Nexus Mutual and Unslashed, and often constitutes a major cost for staking protocols. In a recent staking panel at ETH Denver, it was mentioned that slashing insurance negatively impacts staking APR by up to 1 percentage point. Lido was at one point spending 25% of annual revenues on slashing insurance. While DVT doesn’t mitigate slashing risk completely, it does reduce it. With lower risk, stakers can feel comfortable with less insurance.

Assuming that using DVT can reduce the insurance premium by 25%, implies annual savings of ~$125/validator at current prices. With 50% DVT penetration, the total opportunity that DVT can unlock is $35m, or $3.5m for the platform with a 10% fee. Again, these parameters can be flexed - two scenarios below:

When thinking about the valuation of DVT tech, the key drivers are:

DVT adoption (what % of validators are being run using DVT?)

ETH staking ratio (how many validators are there?)

ETH price (affects the dollar value of DVT, but not in ETH terms)

Based on these two approaches, it seems that the more immediate benefit from DVT comes from the reduction in slashing risk and subsequent insurance premiums. Homestakers have more to gain from liveness as they typically have a worse setup than professional stakers and suffer from lower performance.

Since DVT can provide both higher liveness and reduce slashing risk, the two approaches are complementary. In other words, the maximum a validator would be willing to pay is the sum of the two. In addition to these two, professional stakers stand to benefit from reduced hardware spend as DVT allows them to better optimise their operations (run the same amount of nodes on fewer machines due to higher security).

Where do we go from here?

Most announcements today are centred around ETH-staking providers. However, the technology can be extended to other use cases. Two examples include:

Expanding to other ecosystems: Not only Ethereum can benefit here, but also other PoS networks. The biggest factor to consider is block time, which has to be slow enough for node operators to achieve consensus. Of the current L1s, Cosmos seems like a potential candidate with 5-6s block times. DVT could also add robustness to the consensus layer, given the validator set on Tendermint is limited to 175 (as of now). Obol is building in the space, but the different architecture means that it’s basically a new project that starts from scratch.

Running L2 sequencers with DVT: Sequencers fit the bill of a node with a high-value function that needs to be online all the time. Most L2s also have big sequencers and as there are only a few of them, it really matters if one is out. DVT could be a good candidate for increasing robustness, as pointed out by Oisin Kyne from Obol.

Concluding thoughts

DVT is still in the early stages. There are only two projects really building in the space, and most staking providers thinking about integrations are either still under development or just running small pilots on testnets.

SSV seems to have had a headstart and benefits from a large ecosystem fund, but Obol is quickly catching up. With fresh funding from large backers and a lean team that can now focus on executing, I would expect this trend to continue. After all, they did beat SSV to mainnet.

While SSV and Obol lead the way, it’s only a matter of time until we start seeing more players building DVT tech (similar to the sudden inflow of various staking providers which are now popping up). If there is opportunity, competition will come. For now, however, the two are quite complementary and serve slightly different clientele.