Disclaimer: Nothing said here should be taken as investment advice. DYOR.

Introduction

The ticketing industry has long been plagued by issues such as fraud, scalping and lack of connection between fans and artists. Despite various attempts, these issues still prevail. My previous post gives an overview of ticketing industry and benefits of NFT tickets over traditional ticketing.

Today we’ll take a closer look at GET Protocol, which is a first mover in the space. By licensing out the backend and providing infrastructure to ticketing companies (both traditional and blockchain based), it’s well positioned to benefit from the overall growth of NFT ticketing.

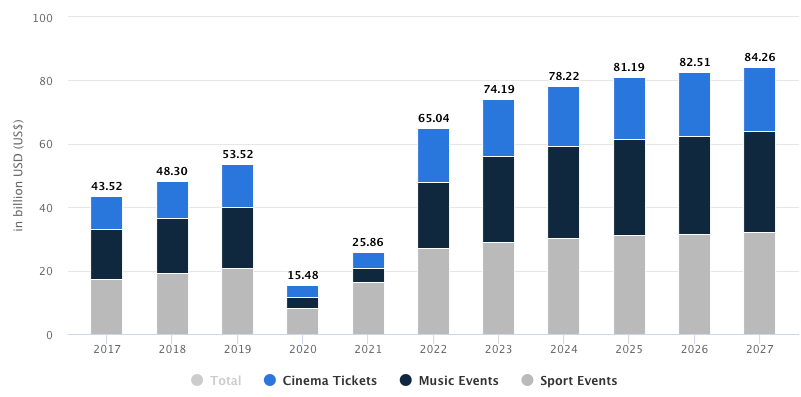

Industry overview

The primary ticketing industry is estimated to be worth ~$65bn and expected to grow at 5% CAGR going forward. It’s dominated by a few players, with Ticketmaster as the #1. While Ticketmaster sells ~500m tickets/year, GET protocol has sold a total of 2.7m tickets in its entire lifetime. So it’s safe to say that NFT ticketing is still in its infancy.

NFT tickets increase transparency and control over secondary market. This helps avoid fraud, has potential to reduce scalping and allows artists/event organisers to benefit from secondary sales. In addition, NFT ticketing introduces new opportunities to help strengthen the relationship between fans and artists.

While artists and event organisers might see the benefit of NFT ticketing, the average person typically shuns away when they hear the word “NFT” or anything related to crypto. This has been a key friction for adoption, and one that GET aims to solve.

Protocol overview

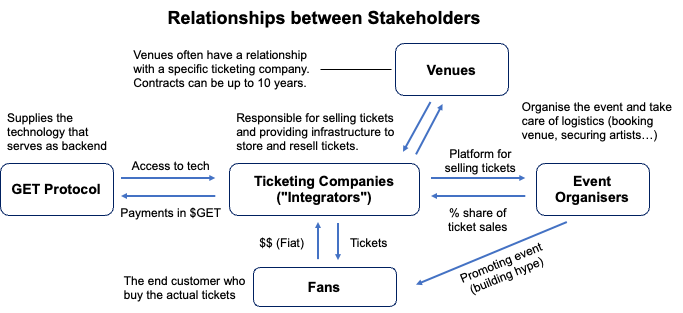

GET Protocol provides blockchain-based ticketing infrastructure. They offer a full end-to-end solution for both traditional and NFT-native ticketing companies.

While the backend runs on blockchain, GET aims to keep frictions for users at a minimum. Users pay with fiat and tickets are stored in a mobile app rather than a wallet. More crypto-savvy users have the option to link their wallet and get NFTs delivered there, but it’s not the default. This hybrid model keeps the pool of potential customers as large as possible.

Founded back in 2016, GET originally launched on Ethereum. Much has happened since the ICO in late 2017. The same team is also behind GUTS tickets, which has served as a proof-of-concept and showcase of their tech. While GET is the backend, GUTS is the frontend through which people buy tickets.

Recent developments include:

Switch to Polygon (May 2021): The switch enabled lower fees and higher throughput. Both are crucial for enabling ticketing at large events.

Introduction of DAO (May 2022): The protocol has been moving towards a more decentralised structure by building up the DAO-governance. Rather than launching it all at once, they are taking a “step-by-step”-approach and learning from each iteration.

Release of V2 (June 2022): An update to the ticketing engine, which significantly improved scalability (316x boost in peak throughput and 11.8x improvement in minting costs). V2 also opened the door for multi-chain deployment in the future.

Tokenomics update (in connection with V2): All ticket revenue is now collected on-chain and settled in GET. This makes value accrual to the token more direct.

Below is an example of relationships between stakeholders:

Products

GET has two main products:

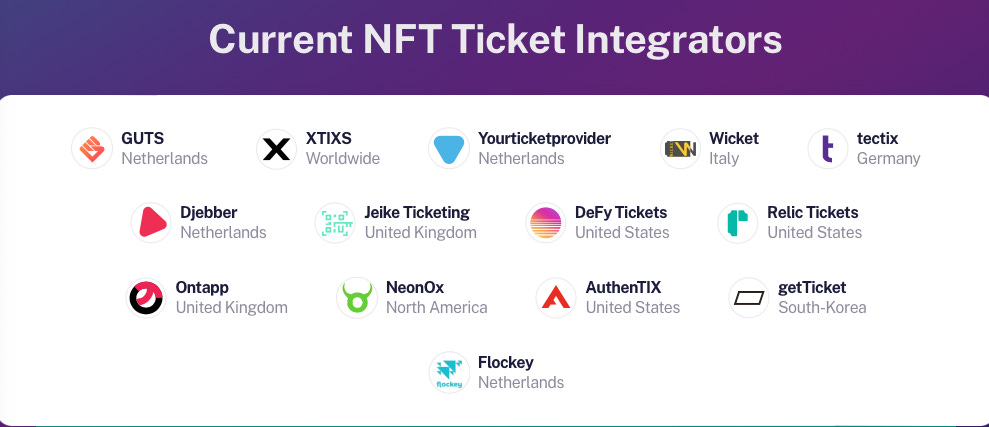

White-label (WL) gives integrators access to GET Protocol’s complete end-to-end ticketing infrastructure. While GUTS has been testing it since the start, the tech was licensed out as a SaaS-model in early 2020. After a bit of a choppy start due to Covid, it has shown good momentum since. Today GET has 14 integrators, who focus on different verticals and geographies.

Digital twin (DT) is focused on existing ticketing companies who often have complex legacy infrastructure. The digital twin allows them to try out NFT-based ticketing with limited implementation risk. Each traditional ticket is twinned, i.e. also issued as an NFTs copy that is processed through GET protocol. The digital twin was launched in September 2021 and speaks to GET’s ambition of servicing the entire industry, not just NFT-native ticketing companies. The first partner is YourTicket, which has sold more than 1.1m tickets already.

What more is to come?

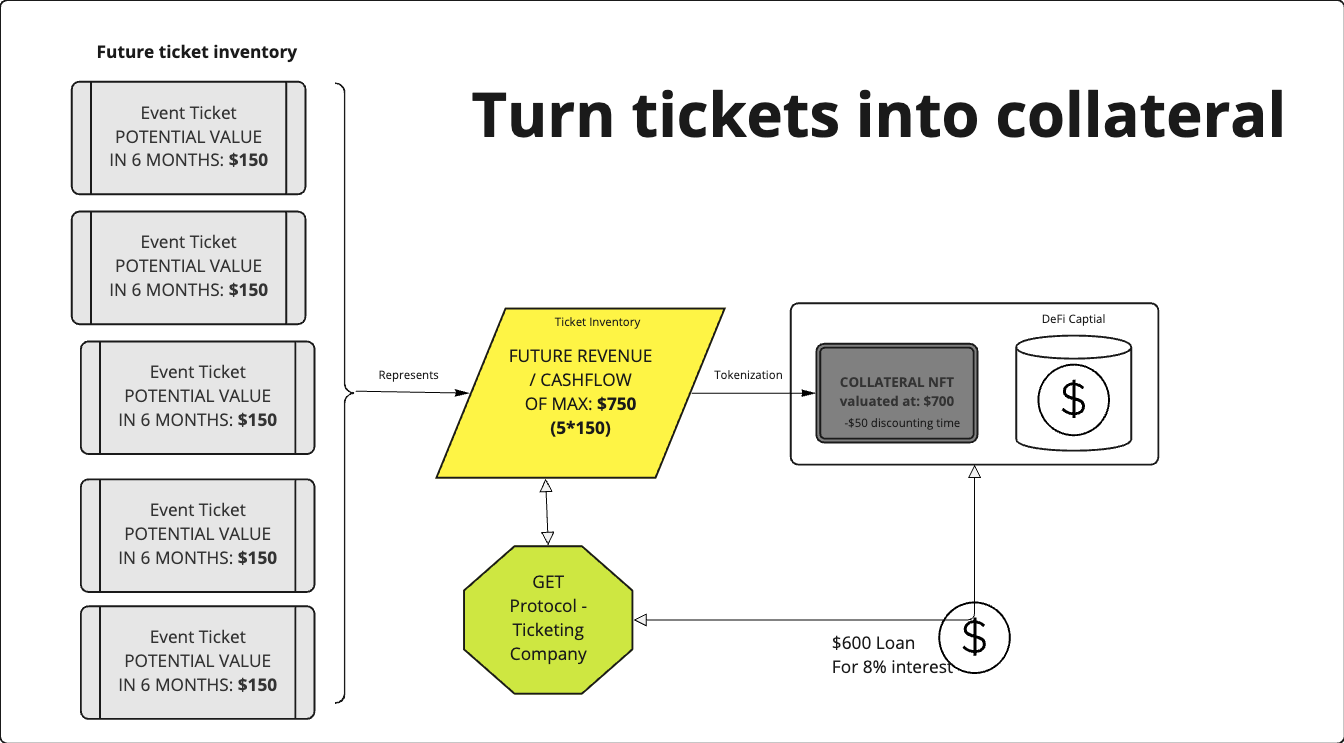

Event financing is a new feature that’s currently being tested. It mixes event organisation with DeFi. Essentially, it allows event organisers to collateralise tickets and borrow against future revenue streams (i.e. sale of tickets).

Organising events is expensive and comes with large upfront costs (securing the venue, artist deposits etc). To bridge the gap between costs and income (~6-10 months), event organisers have traditionally relied on financing from large ticketing companies. GET aims to democratise this process through their event financing module (EFM). One key challenge is quantifying the risks (example: not selling all tickets) and making sure lenders are properly compensated.

Other ideas that have been floated around include establishing a branded marketplace, and more efficient treasury management (perpetual treasury and diversifying to other assets). Staking is on the way, which means that token holders can soon get a share of the profits. Further decentralisation of the protocol is also expected, as the importance of DAO keeps growing.

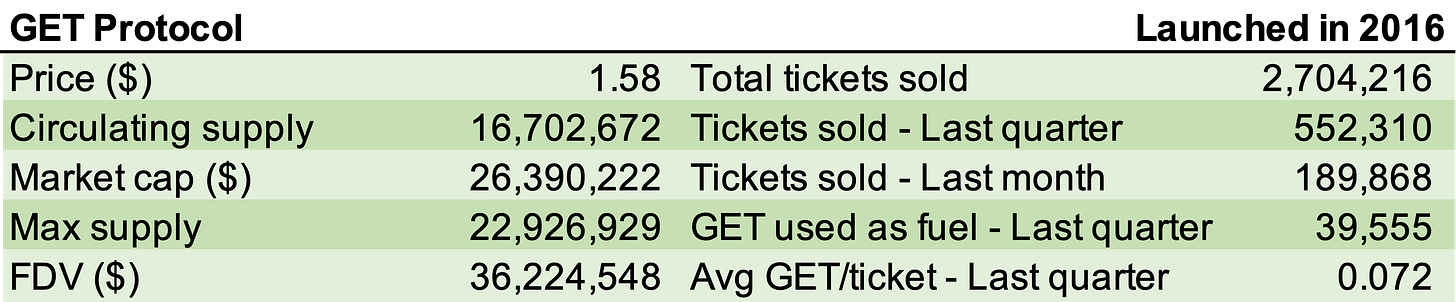

Token supply and revenues

The GET token launched in late 2017 during the ICO-era. The circulating supply is ~16.7m, with the total supply fixed at 22.9m. The balance is allocated to the DAO treasury fund (2.6m) and user growth fund (3.6m).

The main utility of the token is serving as fuel for all tickets which are issued and processed through GET.

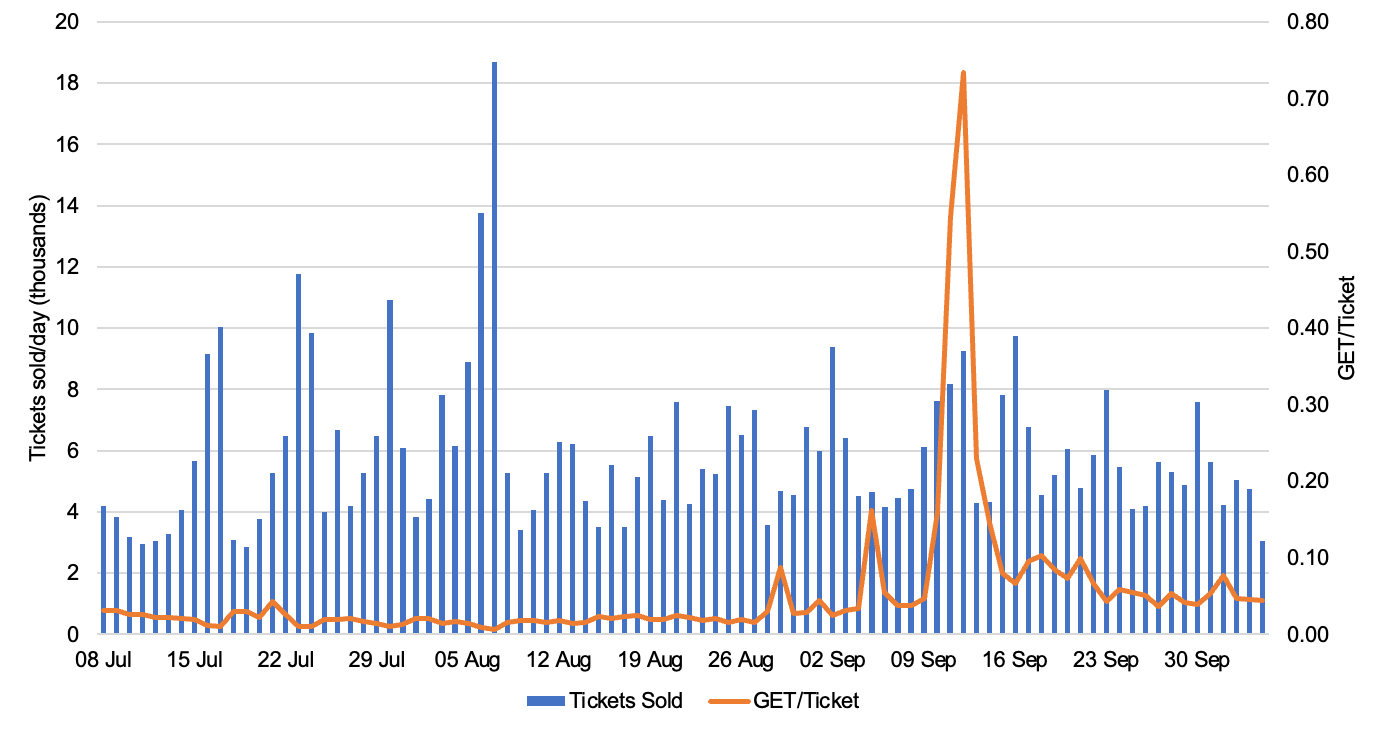

The protocol takes a cut from each ticket sold, which means that revenues are related to number of tickets sold. Ticket sales have shown good momentum with reopening and recovery of events. Monthly sales have been in the range of 180k, which gives an annual run rate of ~2m. White label makes up ~1/3 of the volume, and digital twin the remaining ~2/3.

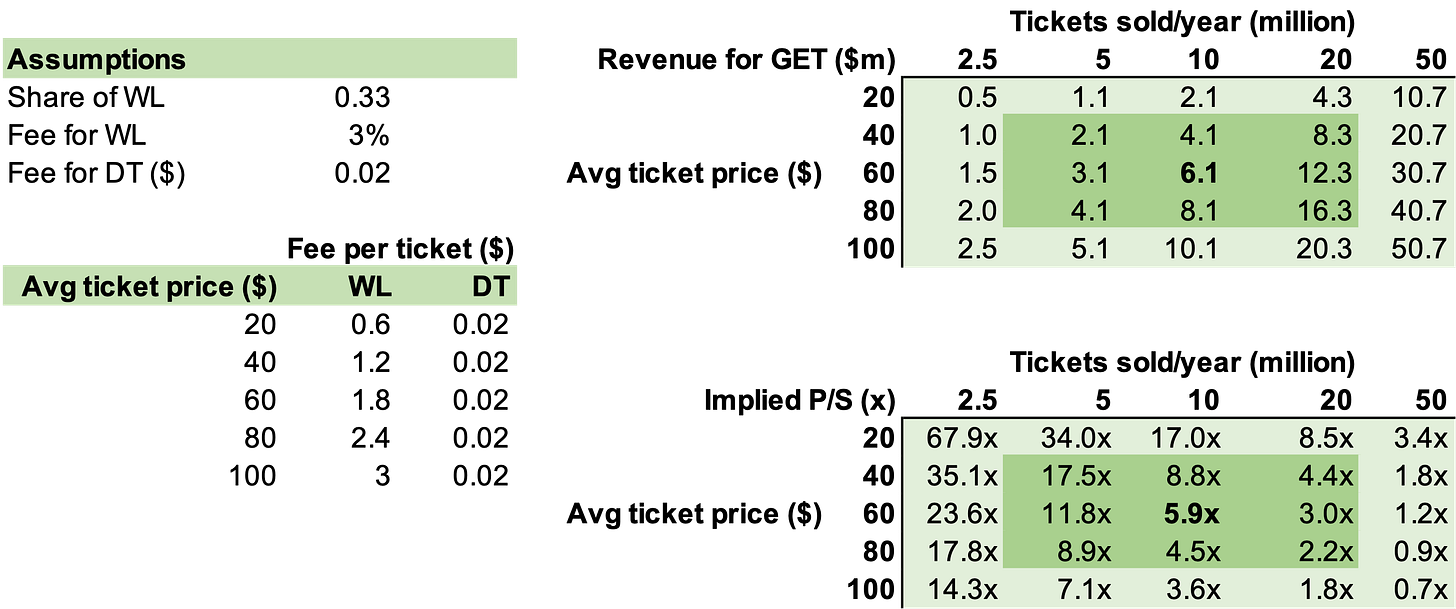

The majority of revenue comes from the white-label. The digital twin helps incumbents experiment in the space, which increases adoption of NFT tickets in the long-term. However, GET charges a flat fee of $0.02/ticket for the digital twin, compared to 3% for the white label offerings. The difference in earnings per ticket is quite stark (table below).

The ratio between GET/ticket has averaged at 0.07 over the past quarter. The ratio depends on a) share of white label from total ticket sales, b) average value of ticket and c) price of GET, since fees are calculated based on nominal value of ticket. Given the many moving variables, it’s more useful to look at nominal revenues (in dollars).

While a rough estimate, this back of the envelope-calculation can give some colour on future earnings potential. In this case, I assume the ratio between WL and DT stay constant (1/3 vs 2/3) and no revenue from event financing or other sources.

Team

Most of the team is based in Amsterdam and is currently about 30-people strong. Key people include:

Maarten Bloemers - CEO & Co-founder

Ivo van der Wijk - CTO & Co-founder

Tom Roetgering - CCO & Co-founder

Frans Twisk - Product Designer & Co-founder

Olivier Biggs - Marketing Manager

Kasper Keunen - Blockchain Developer

Jack Turnbull - Engineering Manager

Competitive landscape

Competition comes from two main dimensions - incumbents and other NFT ticketing protocols:

Incumbents include the likes of Ticketmaster and Eventbrite who have decades of experience from ticketing. However, it’s another question whether they understand and appreciate the value of NFTs and other Web3-native ideas. Given both the technological and ideological gap, it seems likely incumbents would rather partner with an existing protocol (such as GET) than build out their own tech. Ticketmaster’s recent collaboration with Flow seems to support this argument.

It also acts as a testament to the fact that incumbents are indeed not sitting still, but trying to keep up with the industry. While the risk of direct competition from incumbents might be limited, it is with these guys that that GET is competing with to get event organisers’ attention.

Other NFT ticketing protocols include the likes of Yellowheart and SeatlabNFT. This is a more direct risk, as these protocols are competing for a share of the same pie. However, given how nascent the space still is, there is room for more than one player. It’s also likely we see some specialisation down the line, with certain protocols focusing on different verticals and geographies.

Conclusion

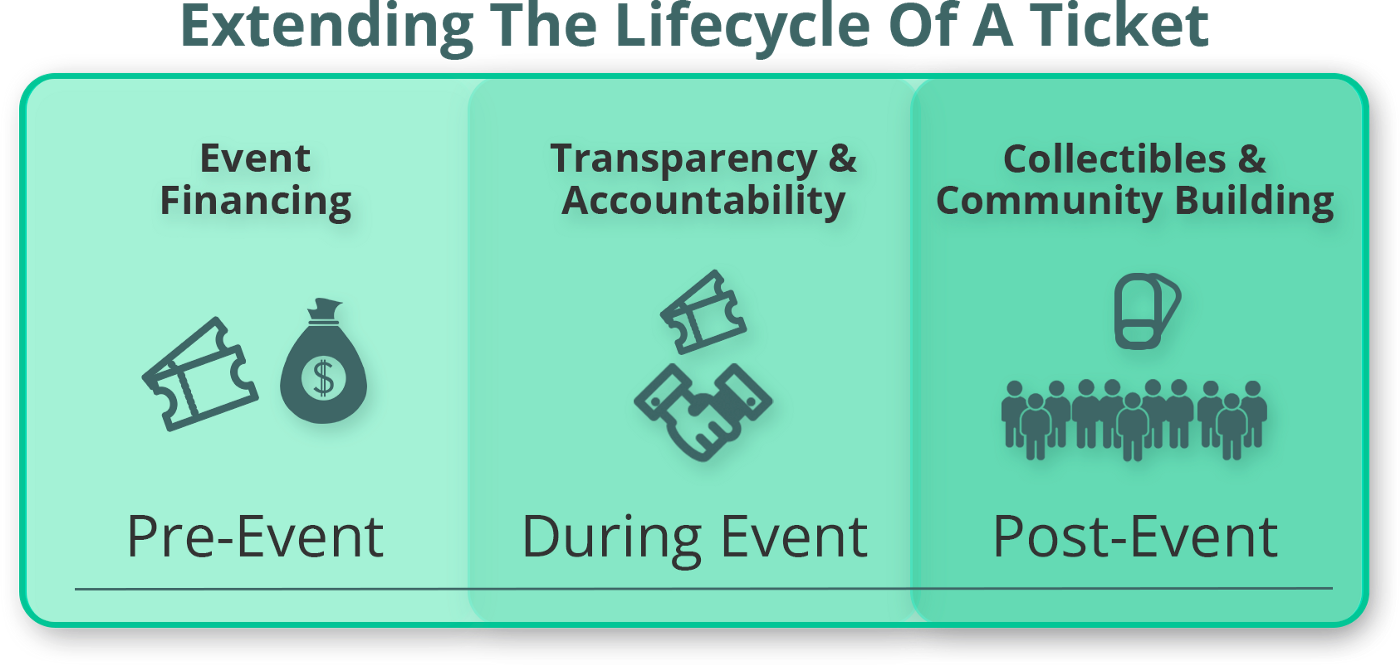

Ticket are becoming more and more important as thinking around NFTs and digital identity evolve. Their lifecycle also extends as the number of use-cases evolve. Rather than being thrown away after a concert, tickets can act as proof-of-attendance or help with community building. They can even become valuable in their own right (NFT-based art or highlights, for example).

GET is well-placed to not only benefit, but accelerate the transition to NFT ticketing. Ticketing can also benefit the wider industry by introducing more users to NFTs and the idea of digital identities.

To end on a quote from the team: “NFT tickets are the most accessible vehicle into Web3 for the everyday person”.