Financialisation of JPEGs - An overview of the NFT-Fi space

Covering exchanges, lending, accessibility and derivatives

NFTs Are Here to Stay

While trading volume is down >75% from the peak (even after adjusting for wash trading), NFTs aren’t going anywhere. If you look under the surface, you notice that the supporting infrastructure is rapidly improving and trade count has been showing signs of recovery.

The last cycle was about experimentation and the next one will be about expanding use-cases. A part of the NFT-market will continue to exist to signal wealth or belonging to a community (digital flexing rights). However, there is a wide array of other applications that will grow beside it. These include both utility-based (ticketing, music, gaming…) and pure art-based (1/1s, AI-generated art, PFP-collections…). I’ve previously written about the role of NFTs in ticketing, music and as a tool for portfolio diversification, that relate to this.

Financial infrastructure is fundamental for a well-functioning and efficient market. It allows for buying and selling with minimal slippage, accessing liquidity and speculating or hedging with the help of derivatives. That’s where NFT-Fi comes into the picture - the supporting infrastructure that makes using and owning NFTs a smooth experience.

This post will cover the following:

What do we mean by NFT-Fi?

Exchanges (Traditional, Aggregators and AMMs)

NFT lending (Peer-to-Peer, Peer-to-Pool and Peer-to-Protocol)

Accessibility (Fractional NFTs, Indexes and Renting)

Derivatives (Options, Perpetuals and Futures)

Concluding thoughts

What do we mean by NFT-Fi?

The core idea of NFT-Fi is about combining NFTs with existing ideas from DeFi. These can be split into 4 main categories:

Exchanges

Lending

Accessibility

Derivatives

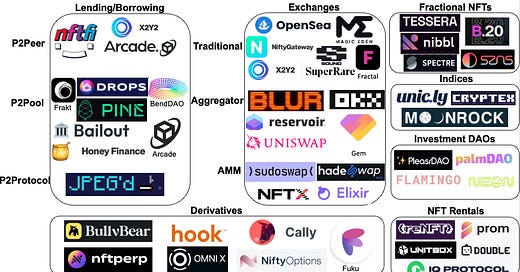

Of these themes, NFT lending and marketplaces are more established and have seen wider adoption. However, the NFT-Fi space is rapidly expanding into new verticals. The chart below gives an overview of players in the different verticals, but a more comprehensive list can be found here.

Exchanges

Exchanges are a key infrastructure that allows users to buy and sell NFTs. A well-functioning secondary marketplace enables price-discovery and valuation, which is the cornerstone for many other applications. Exchanges make money by charging a small fee for matching buyers and sellers, typically between 1-5%. Therefore, the more trading volume, the better.

The original NFT marketplaces such as Opensea are peer-to-peer exchanges. Owners list their NFT for a certain price, and potential buyers can either pay the asking price or make an offer. While the majority of trading happens on the big platforms, we’ve seen specialisation for more niche use-cases. For example, users might shop for music drops at SoundXYZ or browse digital art in a gallery-like view at SuperRare. I would expect this trend to continue as the NFT-space broadens.

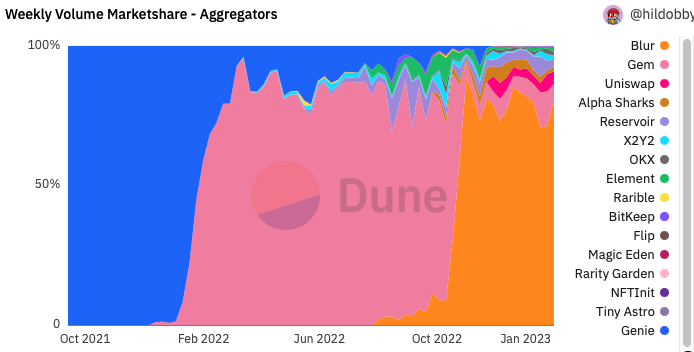

Aggregators collect bids from different marketplaces, aiming to offer the most competitive prices and deepest liquidity. The chart below shows how traders have moved from Genie to Gem to the current #1 Blur, which is both an aggregator and direct marketplace. It launched late last summer and quickly gained popularity, particularly amongst pro-traders. Blur’s features include trading analytics (market depth, live activity feed…), quicker execution with lower gas-consumption, and tools such as “sweep the floor”. Besides controlling ~70% of the aggregator market, Blur accounts for 30-40% of the total NFT trading volume.

A more recent trend is NFT-AMMs, which enables users to buy and sell from a liquidity pool rather than trading with other NFT holders. The aim of the AMM model is to enhance liquidity, reduce fees and improve price discovery. In the earlier attempts (NFTX and NFT20), holders deposited similar NFTs into a pool and mint a derivative fungible (ERC-20) token. The fungible token gave the right to redeem any asset in the pool at any time, which meant that owners wouldn’t necessarily get back the NFT they deposited. This model didn’t really gather much adoption.

The next iteration came with Sudoswap, which is the current leader of NFT-AMMs (launched in July 2022). Sudoswap allows users to create liquidity pools to sell, buy or trade NFTs. The process starts with LPs either depositing their NFTs (seller), ETH (buyer) or both (buy and sell to earn fees) into a liquidity pool. They then indicate a starting price and bonding curve parameters. The traditional constant product curve (XYK) that’s widely used in DeFi is suboptimal for NFTs, since NFTs are often sold in whole quantities and have lower supply than fungible tokens. Hence, it would lead to less efficient use of capital (more here). In the SudoAMM, LPs can choose between three different bonding curves:

Linear with constant delta (example 0.1ETH per buy/sell)

Exponential with X% delta (example 10% per buy/sell)

Concentrated constant product (XYK) - Resembles Uniswap V3, where LPs provide liquidity in a specific range, rather than the whole curve. The concentration allows for the provided capital to be used more efficiently (within the range).

Adjusting pool parameters according to a change in market conditions is both easier and cheaper from the users’s perspective, compared to having to manage each listing separately. However, looking at adoption it seems that AMMs remain a niche within the wider market. Sudoswap only accounts for ~0.5% of the total NFT volume as active users have decreased and creation of new pools is far off the peak.

For now, the AMM model seems best suited for large holders (whales and investment DAOs) who either want to generate yield on existing holdings, or DCA in/out from a collection. While AMMs can provide deeper liquidity around the floor price (basic attributes), it also doesn’t do as well for rarer attributes. Therefore, it seems plausible that we see AMMs focus on larger collections where the “non-fungibility” matters less, such as passes (e.g. SewerPass), virtual land plots or entry-level in-game assets.

NFT Lending

Using art as collateral is not a new concept. The traditional art-lending industry has existed since the late 1970s and the value of outstanding loans has grown to ~$30bn (CAGR of 10.7%, Deloitte 2021 Art & Finance report). Loan-to-value ratios (LTV) typically range between 35-50%, depending on the collateral and issuer of the loan. This means that someone who deposits $100m worth of art, would be able to borrow $35-50m against that collateral. The vast majority of these loans come from private collectors (90%), who primarily use the capital to diversify and make investments outside of art.

The concept of NFT lending is similar. For many early buyers, their NFT holdings can represent a significant portion of their investment portfolio. Borrowing allows them to unlock some of that value without having to sell. Increasing capital efficiency is a key reason why credit markets exist in the first place.

Borrowing against NFTs have two main benefits:

Accessing liquidity without selling and using the borrowed funds either for speculation (buying more NFTs or other investments) or purchase of real world assets.

Turning the NFT into a productive asset by using the borrowed funds to generate passive income/yield.

The three main approaches to NFT lending are peer-to-peer (P2P), peer-to-pool (P2Pool) and peer-to-protocol (P2Protocol. Of the $660m worth of loans that have been issued across the biggest lending platform, P2P accounts for 64% (largely from NFTfi).

Agreeing on the value of collateral is a key problem in NFT-lending (as with any art). Since value is largely subjective, the simplest definition of what something is worth is whatever someone is willing to pay for it. This willingness to pay can be estimated by looking at previous sales or comparable listings (either similar pieces or another collection by the same artists). Large NFT collections benefit from high turnover, which means that floor prices and rarity traits can be used to estimate a market value. However, the illiquidity of the market means that price-volatility is high.

P2P-lending assigns the responsibility of valuation to lenders, while pool-based lending largely relies on price-oracles to automate the process. Innovation on the pricing front include utilising machine-learning (e.g. Banksea Finance) or using optimistic/rational agents-based models (Abacus). However, both of these are still quite early stage and introduce different trade-offs.

Peer-to-Peer Lending:

P2P matches borrowers directly with lenders and loan terms are separately negotiated for each loan. This flexibility makes it easier to take rare-features into account. It also enables a wider range of NFTs to be used as collateral, providing liquidity for a long-tail of assets and not just blue-chip collections. In addition, the platform takes no underwriting risk since it only facilitates the matching between borrower and lender. The general mechanism is simple:

Borrower requests a loan by listing an NFT/collection of NFTs to be used as collateral and specifies the desired loan parameters:

Loan duration (typically 7, 14, 30 or 90 days)

Interest rate (expressed in APR)

Currency (USDC, ETH…)

Loan size (nominal terms or % LTV)

Lenders can either accept the terms directly or make a counteroffer (for example offer the desired LTV, but demand a higher interest rate)

The borrower receives funds after accepting an offer. The NFT moves to a smart contract escrow, where it’s held until the loan is repaid.

If the borrower repays the loan with interest, they get their NFT back. Otherwise, the loan defaults and the lender takes hold of the NFT.

While flexibility has its benefits, the additional steps take time and effort. This makes P2P suboptimal for borrowers who need liquidity quickly. In addition, some lenders might not feel qualified to underwrite loans and determine the right parameters (interest rate etc). Protocols such as MetaStreet, SpiceFinance and GoblinSax aim to solve this by abstracting away the complex underwriting process and aggregate bids from different marketplaces. This resembles traditional credit markets, where banks and specialised underwriters take care of valuing the collateral and setting the interest rate, while the loans are syndicated out to investors.

Another consideration is idiosyncratic risk related to collateral. Traditional art-lending is usually against a basket of assets which gives a more diversified pool of collateral. NFT P2P-lending has previously only been against one asset, but the recent introduction of multi-collateral loans on NFTfi allows borrowers to list multiple NFTs. This is also more gas-efficient from the borrowers perspective, as they don’t need to open multiple loans.

Peer-to-Pool lending:

P2Pool allows NFT holders to access instant liquidity. Lenders provide capital (ETH or another asset) to a general pool, which can be collection specific (for example only lend against Crypto Punks) or general (lend against all collateral). Borrowers can deposit their NFT as collateral and take out a loan from the pool as long as there is available liquidity.

The interest rate and amount available to borrow are set by market forces and depend on utilisation rates. In contrast with P2P lending, loans have no defined duration. As long as the health factor remains above the liquidation threshold, there is no need to pay back. However, the health factor decreases due to the aggregated interest, so eventually borrowers would have to pay down their loan to avoid liquidation.

P2Pool mostly relies on price oracles to value the collateral (NFT), which limits it to established collections that have reliable price feeds. For example, BendDAO (the largest P2Pool lending protocol) only has 8 whitelisted collections that users are able to borrow against. 80% of the collateral value is concentrated in the BAYC- and MAYC collection (see charts below).

While quick access to liquidity is a key selling-point for P2Pool, there are a few downsides:

Less customisability means that some borrowers are worse off with pool-based lending than P2P. Taking rarity into account is more difficult in an automated way, since most oracles use floor prices to value the collateral.

Price-oracles can be manipulated: The more illiquid a collection, the easier it is to manipulate. For example, a large actor could list several NFTs from the collection significantly below the floor price, in an attempt to trigger liquidation on the loans in the pool. Attempts to avoid this problem include using average prices over a specific period (e.g. average floor price over 7 days). However, that introduces liquidation-delays in a real-scenario which is not optimal either.

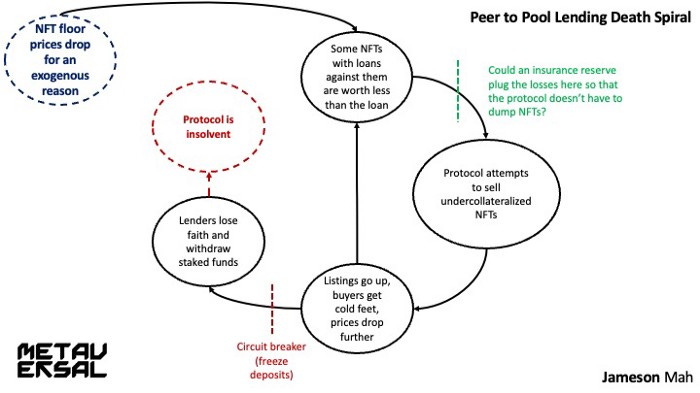

Risk of death spiral: The NFT market is volatile and prices can drop significantly in a short time. This means that a pool-based lender can find themselves in a position where the loans are suddenly under-collateralised. Large fire sales add pressure to an already weak-market, which lead to haircuts for lenders (visualised below). This is essentially what happened to BendDAO last August. Therefore, P2Pool introduces significantly higher systemic risk than P2P in their current state.

Peer-to-Protocol:

The third way for borrowers to get liquidity on their NFTs is Peer-to-Protocol, or Non-Fungible Debt Positions (NFDP). This model resembles MakerDAO, where borrowers deposit collateral into a vault (in this case NFTs) against which the protocol issues a stablecoin backed by that collateral. Similar to P2Pool, borrowers get instant liquidity and the valuation of collateral is automatic. However, the main benefit of NFDP over P2Pool is lower borrowing rates (cost of liquidity). Users can typically borrow at low-single digits compared to the 30-40% at pool-based protocols. This is mainly because there are no LPs (lenders) that need to be compensated and instead the protocol acts as direct counterparty.

The most notable protocol in this category is JPEG’d, with $23.5m worth of NFTs locked in. Borrowers can mint PUSd (the protocol‘s native stablecoin) for 2% APR or pETH (Ethereum derivative) for 5% APR against their collateral. JPEG’d currently supports 11 blue-chip collections and collateral-ratios start at 35%, but can go as high as 60%. Rare traits are taken into account for both Punks and Apes, which improves the capital efficiency of those NFTs.

The main risk of borrowing with JPEG’d is de-pegging of the borrowed tokens (PUSd or pETH). Similarly to P2Pool lending, there is a risk of death spiral and the pool becoming undercollateralised. However, in this case borrowers or holders of PUSd/pETH draw the short-stick, since these tokens are backed by the pool of collateral. The total PUSd circulating has decreased significantly since November, a sign of investors de-risking after the FTX collapse and paying back some of their loans.

Accessibility

NFTs started out as a niche gimmick, but have since then soared in value with some collections having sold for millions. While early buyers are riding into the sunset with a wide smile, the high prices exclude a large segment, particularly new entrants. Accessibility can be improved by a few different ways:

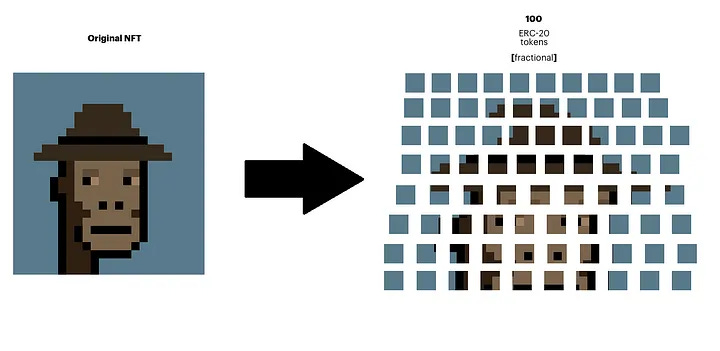

Fractionalisation involves splitting an NFT into multiple pieces and issuing fungible tokens (ERC-20) that represent a fractional claim to the underlying NFT. For example, splitting an NFT into 1,000 fungible tokens, where each token has a 1/1,000 claim to the original NFT. While the lower price point enables more people to get involved, fractionalisation only gives price-exposure as utility can’t be shared across holders. Therefore, fractionalisation seems most useful for expensive pieces and 1/1 collections (Tessera, previously Fractional), or crowd-funding specific NFTs (PartyBid).

Indexes have grown to become a bedrock of investing in traditional finance, so what’s stopping that from happening in the NFT-space? The main benefits of indexing are cheap diversification and outsourcing the portfolio rebalancing to someone else. However, similarly to fractionalisation, indexes only give price-exposure and none of the underlying utility from actually owning the NFTs. That said, they might still be worth including in the portfolio as a passive bet on the industry. Providers of NFT-indexes include:

Cryptex Finance recently launched a JPEGz token, which is based on the top 10 NFT-collections by market cap.

Moonrock provides a collection of blue-chip and premier NFTs through $JPG (Previously an Index Coop product).

Nansen provides indexes for analytical purposes rather than investing. These can be useful when looking at the overall performance or trends within a sub-industry. Nansen has indexes for the broader market as well as more niche ones, such as gaming or metaverse.

Investment DAOs can act as quasi-indexes, with the added benefit of holders being part of a community and having influence over investment decisions. The core idea is that a group of people come together and pool their capital, which is then used to invest in NFTs (or other assets). Participants get tokens that represent the share of their initial contribution, whose value might increase over time if the DAO makes successful investments. Therefore, all members are incentivised to come up with investment ideas that benefit the collective. Examples of investment DAOs that allocate in the NFT-space include FlamingoDAO and PleasrDAO.

Renting/Leasing is a small market today, but has potential to become an important part of the industry. Renting is primarily targeted at NFTs with utility, but could also exist for pure art-based NFTs (similar to renting of traditional art). An existing example that fits the bill is the BAYC-collection, where the NFT also acts as an entry-ticket to IRL events and parties. If the owner knows they won’t need the NFT for the next two months, they could rent it out for some additional income (similar to renting your house while you are on holiday). The borrower pays a rental fee and gets access to the utility, without having to commit the capital to buy the NFT. A win-win for both!

Renting can either be collateralised (renting requires capital to secure the trade) or non-collateralised (creating a “wrapped NFT'' that is burned once the contract ends). In the latter case, the renter actually never receives the original NFT. Examples of protocols in the rental space are reNFT and IQ Protocol.

Derivatives

Derivatives (options, futures and margin trading) are valuable for two main reasons - speculation and hedging. They improve market liquidity and price discovery, which in turn opens up the market for bigger players and accelerates the growth of the industry. The NFT-derivative space is still in its infancy, but a couple examples of protocols building in the space include:

nftperp is an NFT perpetuals trading platform built on Arbitrum, the first one of its kind. It allows traders to bet on the prices of blue-chip NFT collections with up to 10x leverage. It’s currently in private beta (1,400 traders), but has already done $80m in volume in just 2.5 months. It also allows holders to see the general sentiment around their collections (as seen in the graph below for BAYC and Punks).

BullvBear is a peer-to-peer platform that allows users to trade American put options on NFT collections. Bulls can purchase slightly below floor betting on the price to rise, while bears bet on a falling price. The offering is limited to collections with high volatility (based on volume and price) and affordable floor price (< 1ETH). The settlement deadlines are from a few hours up to a few days. BullvBear launched a closed mainnet in January 2023.

Source: BullvBear

Concluding thoughts

All in all, efficient markets have benefits that extend far beyond the first-order effects (such as cheaper transaction costs). Innovation tends to be modular in this space, so it’s important to get a strong foundation to build on top of.

There is no one-size-fits-all model. Different approaches have different tradeoffs. However, having the option to choose is valuable and users can tailor their approach so that it fits their specific need.

The two smaller verticals that excite me the most are rentals and perp-trading. Perp-trading has a more immediate use case with owners being able to hedge their position without selling (still eligible for airdrops and other utility). It also enables speculation with less capital, which means more people are able to take a view on the current price of a collection. Therefore, I’m following nftperp and other protocols in the space closely to see how adoption evolves. NFT rentals are interesting from a perspective of capital efficiency, as a lot of things in our economy are based on renting/leasing. NFT-rentals still lack product market fit, but the growth of gaming could be a catalyst for that space.